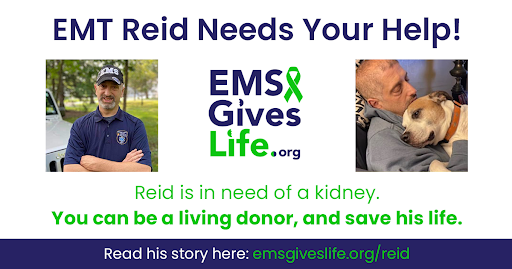

Help Firefighter EMT Dave Find his wife Kelly a Kidney

Help Firefighter EMT Dave Raymond find a Kidney for his wife Kelly

Dave Raymond is asking you to help him save the life of his wife, Kelly! Kelly needs a kidney transplant to live. Both Dave and their son, Christopher, are firefighter EMTs. They are committed to saving people’s lives every day. The hardest thing in the world is not being able to save Kelly on their own. Now Dave is turning to the community and his fire service/EMS family to ask for help.

A Message from Dave Raymond

My name is Dave Raymond and my lovely wife is Kelly. I’m a Lieutenant on the Hamilton (MA) Fire Department and an EMT/ESO Manager for Cataldo Ambulance. Kelly and I have been married for 27 years and are proud parents of a son, Christopher, who is also a firefighter EMT for Hamilton Fire. Our family has a strong history of community involvement and a dedication to helping others. We are blessed with a great family and friends who are of tremendous support. Like all families, we have had obstacles to overcome and we’ve always figured it out. When Kelly’s kidneys started to fail and she was placed on the transplant waiting list in 2020, I really thought I would be her donor and everything would be okay. I have since learned that I’m not medically eligible to be a kidney donor. I never thought I would be asking for this type of help from friends, acquaintances, and even strangers, but here I am, asking for someone to be a kidney donor for my wife, Kelly. I need help to save her!

Kelly’s Medical History of Diabetes and Kidney Disease

Kelly has struggled with medical issues all her life. She has Type 1 (Juvenile) Diabetes which created many health complications. But one by one, Kelly has overcome and moved on, keeping an incredibly optimistic outlook. In 2013 she lost her leg to diabetes but has adapted very well. In 2020 her kidneys started shutting down rapidly and it was determined that she would need a kidney transplant to live. In the meantime, Kelly is doing dialysis 7 days a week to keep going. It is difficult, but we are grateful that dialysis buys her some time while we search for a donor. Many people have stepped up for Kelly and all but one has been found medically ineligible to donate. Unfortunatley the one approved donor had a major family crisis that put kidney donation on hold indefinitely. We are continuing to fight for Kelly and we know that someone will see our story and volunteer to help. When you and your family are used to helping others, it is the hardest thing to do to ask for help – but I’m asking.

“I want my mom to feel better and live without constant sickness.”

– Christopher Raymond, son, Firefighter EMT

Becoming a Kidney Donor for Kelly

This is the most important thing to know – you do not need to be a match to be a kidney donor for Kelly! If you are healthy enough to be a kidney donor, you can donate on Kelly’s behalf. Through the National Kidney Registry’s standard voucher program, you can donate a kidney to someone who is the best match to you. And because of your donation, you can give Kelly a voucher that will take her from the 100,000-person national waiting list to a National Kidney Registry living donor list. They will find her a match typically in months, instead of years. But she is only eligible for the living donor list if someone donates a kidney on her behalf. That’s why we need you.

Important Information for Potential Donors

- Kelly is a patient at Massachusetts General Hospital in Boston which is a National Kidney Registry (NKR) member center.

- You do not need to be a match to be a kidney donor for Kelly. If you are healthy and eligible to donate a kidney, your donation can provide Kelly with a voucher that prioritizes her for a kidney donation that is her best match.

- You do not need to come to Boston to donate a kidney on Kelly’s behalf. You can be evaluated and donate through any of the National Kidney Registry’s 100 member centers nationwide.

- One healthy kidney can do the work of two and donors can live a full, healthy life with only one kidney. Kidney transplant surgery is very safe with a short hospital stay and fairly quick recovery times.

- There is no financial burden for donors. Kelly’s insurance pays for all medical testing, evaluation, and surgery. NKR’s Donor Shield program provides reimbursement for lost wages, travel, and lodging.

- There are supports and protections available for living donors as well as mentoring by someone who has been a living kidney donor. In the unlikely event that a kidney donor needs a kidney transplant in the future, they will be prioritized on the living donor list.

- EMS Gives Life will provide support to potential donors, from considering donation through the donation process.

- There is no commitment to learn more.

- All inquiries are held in complete confidence by EMS Gives Life.

Would you consider being Kelly’s kidney donor?

Good news…

You don’t need to be an exact match to be a donor for Kelly!

If you’re healthy enough to donate a kidney, you can be a donor on Kelly’s behalf!

- You can do testing, evaluation, and surgery at a hospital close to home and on your schedule.

- You will get cost reimbursement for lost wages, travel, and lodging.

- You will be prioritized for a kidney donation in the unlikely event that you need a kidney transplant in the future.

- You can receive mentoring from a living kidney donor.

The National Kidney Registry’s Donor Shield and the National Kidney Donation Organization provide resources and supports to living kidney donors. And EMS Gives Life will be with you, every step of the way!

Sign Up to be a Kidney Donor for Kelly

Take the first step to start the screening process and request a mentor. There is no commitment to exploring the idea of being a kidney donor.

Learn More about Kidney Donation

Click here to learn more about living kidney donation, donor resources, and best practice approaches to donating your kidney to a specific recipient.

In his State of the Union address, President Biden announced an ambitious strategy to address our national mental health crisis. At the Health Resources and Services Administration, we stand with the President in his call for unity in our national response and know that for the millions of Americans living with a mental health condition or caring for a loved one with a mental health condition, the time for action is now.

In his State of the Union address, President Biden announced an ambitious strategy to address our national mental health crisis. At the Health Resources and Services Administration, we stand with the President in his call for unity in our national response and know that for the millions of Americans living with a mental health condition or caring for a loved one with a mental health condition, the time for action is now. In February, HRSA announced the winners of the Promoting Pediatric Primary Prevention Challenge, $66.5 million to support community-based vaccine outreach efforts, more than $560 million in pandemic relief payments to health care providers, funding to increase virtual care quality and access, and new funding to support primary care residency programs.

In February, HRSA announced the winners of the Promoting Pediatric Primary Prevention Challenge, $66.5 million to support community-based vaccine outreach efforts, more than $560 million in pandemic relief payments to health care providers, funding to increase virtual care quality and access, and new funding to support primary care residency programs.

With this funding, nearly $19 billion will have been distributed from the Provider Relief Fund and the American Rescue Plan Rural provider funding since November 2021

With this funding, nearly $19 billion will have been distributed from the Provider Relief Fund and the American Rescue Plan Rural provider funding since November 2021

Our

Our  A

A  Climate change influences human health and diseases in numerous ways. Underserved communities stand to bear the brunt of these climate-induced risks (e.g., extreme heat, poor air quality, flooding, extreme weather events). HRSA and CDC’s Climate and Health Program invite you to consider the impacts of climate change on the U.S. health care system. CDC will share its work to build resilience to these public health effects.

Climate change influences human health and diseases in numerous ways. Underserved communities stand to bear the brunt of these climate-induced risks (e.g., extreme heat, poor air quality, flooding, extreme weather events). HRSA and CDC’s Climate and Health Program invite you to consider the impacts of climate change on the U.S. health care system. CDC will share its work to build resilience to these public health effects.

Children’s mental health continues to be a top priority for state leaders across both legislative and executive branches of state government. With COVID-19 exacerbating the challenges children are facing, there is much more work to be done.

Children’s mental health continues to be a top priority for state leaders across both legislative and executive branches of state government. With COVID-19 exacerbating the challenges children are facing, there is much more work to be done.