Talking Medicare: First Interim Evaluation Report on Medicare Prior Authorization (An 80-page report confirming what you already likely suspected)

On February 28, 2018, the Centers for Medicare and Medicaid Services (CMS) posted an interim report on its prior authorization demonstration project for repetitive, scheduled, non-emergent ambulance transportation. The report, titled First Interim Evaluation Report of the Medicare Prior Authorization Model for Repetitive Scheduled Non-Emergent Ambulance Transport (RSNAT), was conducted by Mathematica Policy Research, a nonpartisan think tank. Mathematica studied the impact of the prior authorization model on Medicare payments, ambulance utilization, and patient quality of care.

Background

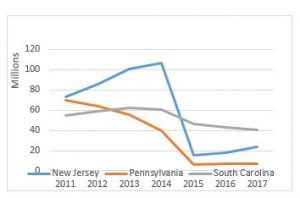

CMS implemented the prior authorization demonstration project in December 2014 in three states: New Jersey, Pennsylvania, and South Carolina (referred to in the report as “Year 1 States”). These states were selected based on higher-than-average utilization rates and high rates of improper payment for these services. The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) subsequently expanded the demonstration project to five additional states (Delaware, Maryland, North Carolina, Virginia, and West Virginia) and the District of Columbia on January 1, 2016 (referred to in the report as “Year 2 States”).

The goal of the demonstration project was to study the impact of prior authorization on the utilization of ambulance transportation. Under the program, ambulance suppliers in the affected states would be required to submit documentation related to medical necessity to their Medicare Administrative Contractors (MACs) prior to Medicare payments being authorized. The MACs would review this documentation, and approve those they felt were medically necessary, while denying those patients that they believed could be safely transported by other means.

Reports Methodology

Mathematica was retained by CMS to conduct a five-year evaluation of the impact of the RSNAT prior authorization model. Specifically, Mathematica was asked to evaluate the program on five specific measures:

- The effect of prior authorization on Medicare use and cost. Did the model realize savings for the Medicare Program?

- How does the prior authorization model affect the quality of and access to care for Medicare beneficiaries?

- How does the prior authorization model affect Medicare program operations? What was the impact, if any, of the model on MAC operations?

- How does the prior authorization model impact non-emergency ambulance suppliers’ and other health care providers’ behavior? Did ambulance suppliers and other health care providers change their behavior in response to the model?

- Does prior authorization impact improper payment rates, the rate at which claims are denied, and related program integrity concerns?

Mathematica indicated that it conducted its review using both quantitative and qualitative data analysis. It analyzed data from January 2012 through June 2016. Mathematica noted that it estimated program effects by measuring the change over time in certain key metrics between the pre-model years (2012 through 2014 for Year 1 States, 2012 through 2015 for Year 2 States) and post-implementation years (2015 through 2016 for Year 1 States, 2016 for Year 2 States) in the nine model states. It also compared these states against non-model states.

Because dialysis patients account for more than 75% of all repetitive transports, the report focused on ESRD patients.

Key Findings

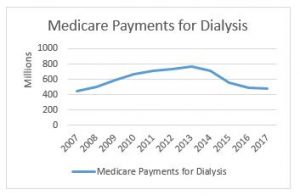

The study concluded that the RSNAT prior authorization model successfully reduced the utilization of ambulance, as well as Medicare’s expenditures on repetitive ambulance transportation. The report indicated that a reduction of nearly 70% in the nine states combined. This was associated with an approximately $171 million reduction in Medicare payments for dialysis transports. Interestingly, the study concluded that it also led to a reduction in total Medicare FFS expenditures for ESRD beneficiaries.

Not surprisingly, the Year 1 States saw more dramatic reductions than the Year 2 States. Mathematic attributed this to the fact that the Year 1 States were specifically selected based on higher-than-average utilization rates, while the Year 2 States were selected based on their geographic proximity to the Year 1 States. Mathematic concluded that national expansion would likely result in additional reductions in Medicare payments, but that the impact would likely be less than what was seen with the Year 1 States.

With respect to issues related to access and quality of care, Mathematica found little quantitative evidence to suggest that prior authorization had a negative impact on quality or access to care. The authors noted that they defined a negative impact quite narrowly, limiting it to emergency department visits, emergency ambulance utilization, unplanned hospital admissions, and death. The study did note a 15% increase in emergency dialysis use, which the authors noted might suggest that some beneficiaries were delayed in receiving ESRD treatment. The authors further noted that some beneficiaries who were denied approval could experience difficulty in accessing alternative means of transportation. Finally, the study did note that stakeholders, including ambulance suppliers, expressed concerns that some beneficiaries may have turned to other services — including emergency ambulance transportation and ED services — in response to being turned down for ambulance transportation.

The study indicated that the MACs reported that they successfully implemented the prior authorization model, and that they have adequate staffing to ensure that they meet CMS’ timelines for responding to prior authorization requests. The MACs did note, however, that there were some difficulties in implementing the program in the Year 1 States, which they attributed to their underestimating the required amount of training. The MACs self-reported that they did far better implementing the program in the Year 2 States.

The impact on the ambulance supplier community was mixed. Mathematica noted a 15% decrease in the number of ambulance suppliers per 100,000 beneficiaries in the model states after implementation. The majority of the ambulance suppliers that (euphemistically) “left the program” were smaller services that specialized in dialysis transports. Other companies reported that they reduced their volume of dialysis transports, or stopped transporting dialysis patients entirely. Not surprisingly, the ambulance supplier community believed that the coverage standards being used by the MACs were too strict.

Finally, Mathematica indicated that it was difficult to determine the prior authorization model’s impact on improper payments. This was partly due to the fact that improperly paid claims for ambulance services increased in both the model states and non-model states during the review period.

Analysis

Mathematica’s findings do not come as a surprise. Rather, they pretty much confirm what our industry has long recognized. The HHS Office of the Inspector General has long warned that dialysis transports are susceptible to overutilization. The Medicare Payment Advisory Commission (MedPAC) concluded the same thing in a June 2013 report to Congress.

Moreover, the A.A.A. has acknowledged the potential for fraud and abuse in connection with these transports. It was for this precise reason that the A.A.A. pushed for prior authorization as a better alternative to reductions in Medicare’s payment for dialysis transports. Our position was that payment reductions failed to adequately address the underlying incentives for overutilization, and, therefore, primarily punished the legitimate providers of such transports.

To its credit, Mathematica acknowledged that factors other than the ambulance suppliers’ financial motives contribute to overutilization. Specifically, it cited the difficulty many beneficiaries face in accessing alternative means of transportation, even where such alternative means would meet the patient’s medical needs. Mathematica also noted the confusion that exists among other health care providers, particularly physicians, in terms of when Medicare would cover an ambulance. Long term, my hope is that this acknowledgement will pave the way towards more constructive conversations between the industry and Congress, CMS, and other stakeholders.

In the short term, the report clears a statutory hurdle that has prevented CMS from considering the expansion of the prior authorization model to the rest of the nation. It remains to be seen whether CMS believes this report is sufficient to make a determination on national expansion, or whether CMS will want to see additional evidence.

Have an issue you would like to see discussed in a future Talking Medicare blog? Please write to me at bwerfel@aol.com.