CMS Announcement on Treatment in Place Waiver

Please either or Join!

Written by Tristan North on . Posted in Government Affairs, News, Regulatory, Reimbursement.

Written by Brian Werfel on . Posted in Drugs & Pharma, Emergency Preparedness, Medicare, Reimbursement.

CMS Increases Medicare Payment for COVID-19 Vaccinations

By Brian S. Werfel, Esq.

On March 15, 2021, the Centers for Medicare and Medicaid Services (CMS) announced that it would be increasing the Medicare payment amount for administrations of the COVID-19 vaccines.

The original Medicare reimbursement rate depended, in part, on whether the vaccine being administered required a two-dose regimen (as is the case for the Pfizer-Biontech and Moderna vaccines), or a single dose (Johnson & Johnson vaccine). For vaccinations that require a two-dose regime, CMS initially paid: (1) $16.04 for the administration of the first dose and (2) $28.39 for the administration of the second dose. For vaccines that require only a single dose, Medicare paid $28.39 for the administration of that single dose.

Effective for vaccinations administered on or after March 15, 2021, CMS has increased these payments to $40 per administration. Thus, the total reimbursement for a vaccine requiring a single dose will be $40, while the total reimbursement for a vaccine requiring a two-dose regimen will be $80.

Written by Brian Werfel on . Posted in Finance, Medicare, Member Advisories, Member-Only, Regulatory, Reimbursement.

Written by Kathy Lester on . Posted in Balance Billing, Member Advisories, Reimbursement.

It appears that members of Congress on the House Ways & Means, Energy & Commerce, and Education & Labor Committees along with the Senate Health, Education, Labor, & Pensions Committee have reached a compromise agreement that will allow “surprise” billing legislation to be considered for passage before the end of the year. While the details of the legislation have yet to be unveiled, the American Ambulance Association has learned that it is likely to include provisions related to ground ambulance service and air ambulance service providers and suppliers.

Earlier legislation moved forward by the House Education & Labor Committee included a requirement for the Administration to create a Federal Advisory Committee to review ways to increase transparency around fees and charges for ground ambulance services and to better inform consumers about their treatment options. We believe that this language will be included in the compromise, but that there may be an opportunity to suggest modifications to make it more balanced and fairer in terms of the charge of the Committee and the types of individuals and organizations who will be selected to participate on it. The AAA is recommending that the Advisory Committee have at least a year to study and report on issues related to balance billing by ground ambulance service providers and suppliers, including the role of local and state governments in EMS systems amongst other considerations. It is also important that the Committee members include representatives from all types, sizes, and geographical areas of ground ambulance service providers and suppliers, as well as state EMS officials, and paramedics and EMTs.

It is likely that if the congressional leadership agree to move this legislation forward, it would be attached to the end of the year packages that may also include COVID-19 relief, Medicare extenders, and the annual spending bills.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

Section 1834(l)(3)(B) of the Social Security Act mandates that the Medicare Ambulance Fee Schedule be updated each year to reflect inflation. This update is referred to as the “Ambulance Inflation Factor” or “AIF”.

The AIF is calculated by measuring the increase in the consumer price index for all urban consumers (CPI-U) for the 12-month period ending with June of the previous year. Starting in calendar year 2011, the change in the CPI-U is now reduced by a so-called “productivity adjustment”, which is equal to the 10-year moving average of changes in the economy-wide private nonfarm business multi-factor productivity index (MFP). The MFP reduction may result in a negative AIF for any calendar year. The resulting AIF is then added to the conversion factor used to calculate Medicare payments under the Ambulance Fee Schedule.

For the 12-month period ending in June 2020, the federal Bureau of Labor Statistics (BLS) has calculated that the CPI-U has increased by 0.646%.

Cautionary Note Regarding CPI-U. Members should be advised that the BLS’ calculations of the CPI-U are preliminary, and may be subject to later adjustment. Therefore, it is possible that these numbers may change.

CMS has yet to release its estimate for the MFP for calendar year 2021. Since its inception, this number has fluctuated between 0.3% and 1.2%. For calendar year 2020, the MFP was 0.7%. Under normal circumstances, it would be reasonable to expect the 2021 MFP to be within a percentage point or two of the 2020 MFP. However, the economic impact of the COVID-19 pandemic makes predictions on the MFP difficult at this point.

Accordingly, the AAA is not in a position to confidently project the 2021 Ambulance Inflation Factor at this point in time. However, the relative low increase in the CPI-U strongly suggests that the 2021 Ambulance Inflation Factor will be significantly lower than last year’s increase of 0.9%.

The AAA will notify members once CMS issues a transmittal setting forth the official 2021 Ambulance Inflation Factor.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

American Ambulance Association Medicare Consultant Brian Werfel, Esq provides a brief update on the HHS COVID-19 Provider Relief Fund.

Written by Brian Werfel on . Posted in Finance, Medicaid, Medicare, News.

On July 7, 2020, CMS updated its Coronavirus Disease 2019 (COVID-19) Provider Burden Relief Frequently Asked Questions (FAQs). As part of this update, CMS indicated that it would resume several program integrity functions, starting on August 3, 2020. This includes pre-payment and post-payment medical reviews by its Medicare Administrative Contractors (MACs), the Supplemental Medical Review Contractor (SMRC), and the Recovery Audit Contractors (RACs). This also includes the resumption of the Prior Authorization Model for scheduled, repetitive non-emergency ambulance transports. These programs had been suspended by CMS in March in response to the COVID-19 pandemic.

Resumption of Medicare Fee-For-Service Medical Reviews

CMS suspended most Medicare FFS medical reviews on March 30, 2020. This included pre-payment medical reviews conducted by its MACs under the Targeted Probe and Educate program, as well as post-payment reviews by its MACs, the SMRC, and the RACs. CMS indicated that, given the importance of medical review activities to CMS’ program integrity efforts, it expects to discontinue its “enforcement discretion” beginning on August 3, 2020.

CMS indicated that providers selected for review should discuss any COVID-related hardships that might affect the provider’s ability to respond to the audit in a timely fashion with their contractor.

CMS further indicated that its contractors will be required to consider any waivers and flexibilities in place at the time of the dates of service of claims selected for future review.

Resumption of Prior Authorization Model

Under the Repetitive, Scheduled, Non-Emergent Ambulance Transport Prior Authorization Model, ground ambulance providers in affected states are required to seek and obtain prior authorization for the transportation of repetitive patients beyond the third round-trip in a 30-day period. The Prior Authorization Model is currently in place in Delaware, Maryland, New Jersey, North Carolina, Pennsylvania, South Carolina, Virginia, West Virginia, and the District of Columbia.

On March 29, 2020, CMS suspended certain claims processing requirements under the Prior Authorization Model. During this “pause,” claims for repetitive, scheduled, non-emergency transports were not be stopped for pre-payment review to the extent prior authorization had not been requested prior to the fourth round trip in a 30-day period. However, CMS continued to permit ambulance providers to submit prior authorization requests to their MACs.

CMS indicated that full model operations and pre-payment review would resume for repetitive, scheduled non-emergent ambulance transportation submitted in the model states on or after August 3, 2020. CMS stated that the MACs will be required to conduct postpayment review on claims that were subject to the model, and which were submitted and paid during the pause. CMS further indicated that it would work with the affected providers to develop a schedule for postpayment reviews that does not significantly increase the burden on providers.

CMS stated that claims that received a provision affirmation prior authorization review decision, and which were submitted with an affirmed Unique Tracking Number (UTN) will continue to be excluded from most future medical review.

Written by Kathy Lester on . Posted in Cost Data Collection, Cost Survey, Regulatory.

As we recently reported, CMS announced that it will be delaying the implementation of the statutorily mandated ambulance data collection system. CMS has released a new set of Frequently Asked Questions (FAQs) clarifying the delay. In sum, ambulance organizations selected to provide cost data for 2020 will now be required to report 2021 data in Year 2. CMS will also add a new set of ambulance organizations for Year 2 reporting as well. This means that twice as many ambulance organizations will be reporting 2021 data in Year 2 and there will be no data reported for 2020. Any organization selected that does not report data will be subject to the 10 percent penalty, unless an exception applies. In addition to addressing concerns about reporting during the pandemic, the FAQs suggest that CMS is concerned that 2020 data “may not be reflective of typical costs and revenue associated with providing ground ambulance services.”

The complete list of these questions, as well as previous ambulance FAQs for COVID-19 on Medicare Fee-for-Service (FFS) Billing can be found here. The new data collections are below.

1. Question: CMS requires selected ground ambulance organizations to collect cost, revenue, utilization, and other information through the Medicare Ground Ambulance Data Collection System. The collected information will be provided to MedPAC, which is required to submit a report to Congress on the adequacy of Medicare payment rates for ground ambulance services and geographic variations in the cost of furnishing such services. Will the data collection and reporting requirements for the Medicare Ground Ambulance Data Collection System be delayed due to COVID-19?

Answer: Yes. CMS has issued a blanket waiver: https://www.cms.gov/files/document/summary-covid-19-emergency-declaration- waivers.pdf due to the PHE for the COVID-19 pandemic. CMS is modifying the data collection period and data reporting period, as defined at 42 CFR §414.626(a), for ground ambulance organizations that were selected by CMS to collect data beginning between January 1, 2020, and December 31, 2020 (Year 1).

Under this modification, these ground ambulance organizations can select a new data collection period that begins between January 1, 2021, and December 31, 2021; collect the necessary data during their selected data collection period; and submit the data during the data reporting period that corresponds to their selected data collection period.

CMS is modifying this data collection and reporting period to increase flexibilities for ground ambulance organizations that would otherwise be required to collect data in 2020–2021 so that they can focus on their operations in support of patient care.

As a result of this modification, ground ambulance organizations selected for year 1 data collection and reporting will collect and report data during the same period of time that will apply to ground ambulance organizations selected by CMS under §414.626(c) to collect data beginning between January 1, 2021, and December 31, 2021 (year 2) for purposes of complying with the data reporting requirements described at §414.626.

For additional information on the Medicare Ground Ambulance Data Collection System, please visit the Ambulances Services Center website at

https://www.cms.gov/Center/Provider-Type/Ambulances-Services-Center.

New: 6/16/20

2. Question: Will the 10 percent payment reduction still apply to ground ambulance organizations that are now required to collect and report data under the modified data collection and reporting period but do not sufficiently report the required data?

Answer: Yes. The 10 percent payment reduction described at 42 CFR §414.610(c)(9) will still apply if a ground ambulance organization is selected to collect and report data under the modified data collection and reporting timeframe, but does not sufficiently submit the required data according to the modified timeframe and is not granted a hardship exemption. The payment reduction will be applied to payments made under the Medicare Part B Ambulance Fee Schedule for services furnished during the calendar year that begins following the date that CMS provides written notification that the ground ambulance organization did not submit the required data.

New: 6/16/20

3. Question: The modification states that the ground ambulance organizations that were selected by CMS to collect data beginning between January 1, 2020, and December 31, 2020 (year 1) can select a new continuous 12-month data collection period that begins between January 1, 2021, and December 31, 2021. Do the ground ambulance organizations that were selected in year 1 have an option to continue with their current data collection period that started in early 2020 or choose to select a new data collection period starting in 2021?

Answer: No. The ground ambulance organizations that were selected for year 1 do not have an option and must select a new data collection period that begins in 2021. CMS cannot permit this option because the data collected in 2020 during the PHE may not be reflective of typical costs and revenue associated with providing ground ambulance services. New: 6/16/20

4. Question: Does the guidance mean that there will be no data reporting in 2021 and that both the ground ambulance organizations that were selected for year 1 and the ground ambulance organizations that will be selected for year 2 will collect and report data during the same time periods?

Answer: Yes. Under the modification, ground ambulance organizations that are selected for year 1 will not collect data in 2020. These ground ambulance organizations will select a new data collection period that begins in 2021 and must submit a completed Medicare Ground Ambulance Data Collection Instrument during the data reporting period that corresponds to their selected data collection period. As a result of the modification, year 1 and year 2 selected ground ambulance organizations will collect and report data during the same time periods. New: 6/16/20

Written by Kathy Lester on . Posted in Advocacy Priorities, Government Affairs, Legislative, Medicare, News.

CMS has issued a blanket waiver modifying the data collection period for the ground ambulance services that were selected to report in Year 1. Under the current law, these organizations would have been required to collect data beginning January 1, 2020, and through December 31, 2020. The waiver allows these organizations to select a new continuous 12-month data collection period that begins between January 1, 2021 and ends December 31, 2021. This modification means that such organizations will collect and report data during the same time period as the ground organizations that CMS will select for Year 2 of the cost collection program.

From the summary of the waiver, it appears that organizations will have the choice of submitting data in Year 1 or Year 2. CMS has not moved the timeline for any other data collection year, so there is the potential for a substantial number of organizations to report in Year 2, which would increase the amount of data available.

The AAA has supported the data collection system to make sure that CMS and the Congress have valid and reliable data to support maintaining the geographic add-ons to the Medicare Ambulance Fee Schedule and to support efforts to address the chronic underfunding of the Medicare Ambulance Fee Schedule.

The complete FAQ is below and also available at: https://www.cms.gov/files/document/summary-covid-19-emergency-declaration-waivers.pdf (on page 29).

“CMS is modifying the data collection period and data reporting period, as defined at 42 CFR § 414.626(a), for ground ambulance organizations (as defined at 42 CFR § 414.605) that were selected by CMS under 42 CFR § 414.626(c) to collect data beginning between January 1, 2020 and December 31, 2020 (year 1) for purposes of complying with the data reporting requirements described at 42 CFR § 414.626. Under this modification, these ground ambulance organizations can select a new continuous 12-month data collection period that begins between January 1, 2021 and December 31, 2021, collect data necessary to complete the Medicare Ground Ambulance Data Collection Instrument during their selected data collection period, and submit a completed Medicare Ground Ambulance Data Collection Instrument during the data reporting period that corresponds to their selected data collection period. CMS is modifying this data collection and reporting period to increase flexibilities for ground ambulance organizations that would otherwise be required to collect data in 2020- 2021 so that they can focus on their operations and patient care.”

“As a result of this modification, ground ambulance organizations selected for year 1 data collection and reporting will collect and report data during the same period of time that will apply to ground ambulance organizations selected by CMS under 42 CFR § 414.626(c) to collect data beginning between January 1, 2021 and December 31, 2021 (year 2) for purposes of complying with the data reporting requirements described at 42 CFR § 414.626.”

Written by Brian Werfel on . Posted in Finance, Medicare, Reimbursement.

On May 1, 2020, CMS updated its “COVID-19 Frequently Asked Questions (FAQs) on Medicare Fee-for-Service (FFS) Billing.” The full document can be viewed by clicking here.

In the updated FAQ, CMS answers three important questions related to ambulance vehicle and staffing requirements:

Written by Brian Werfel on . Posted in Finance, Medicare, Reimbursement.

The Department of Health and Human Services recently updated its guidance on the disbursement of provider relief funds under the CARES Act for the testing and treatment of the uninsured. Previously, HHS indicated that this allocation was only available for the reimbursement of emergency and non-emergency ground ambulance transportation. However, in its most recent update, HHS has removed the restriction that limited participation to ground ambulance providers and suppliers. The new guidance indicates that the relief funds are now available for all emergency ambulance transportation and non-emergency patient transfers via ambulance.

Thus, it appears that air and water ambulance providers and suppliers are now eligible to receive funding for the treatment of COVID-19 patients.

Is there anything my air or water ambulance organization needs to do to claim reimbursement for treatment of uninsured COVID patients?

Yes. In order to be eligible for payments for the treatment of uninsured COVID patients, you must enroll as a participant in the program. Enrollment must be done through an online portal that can be accessed at: http://www.coviduninsuredclaim.hrsa.gov.

Once my organization enrolls, when can we start submitting claims for reimbursement for treatment of uninsured COVID patients?

HHS has indicated that it will begin to accept claims for reimbursement for treatment of the uninsured on May 6, 2020.

FUNDING FOR TREATMENT OF UNINSURED COVID PATIENTS IS SUBJECTED TO AVAILABLE FUNDING, AND IS THEREFORE ON A FIRST-COME, FIRST-SERVED BASIS. IT IS EXPECTED THAT THESE FUNDS WILL BE EXHAUSTED IN FAIRLY SHORT ORDER.

Written by Amanda Riordan on . Posted in Finance, Reimbursement.

Use the American Ambulance Association’s simple form to estimate relief you may receive from the second tranche of HHS COVID-19 funding. Please note that not all providers will receive funds.

More information about this program as well as access to the form you must complete in the General Allocation Portal can be found on the HHS website.

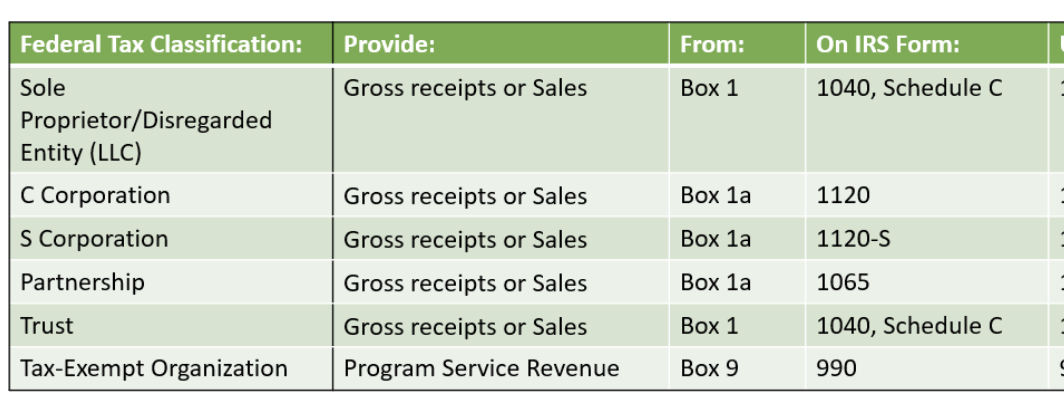

For-profit and non-profit non-governmental providers, to determine your Net Patient Revenue for the portal, use the following information from your most recently filed tax return. (2019 if filed, otherwise use 2018 numbers).

Governmental providers, enter your revenue generated for the last audited financial year. When completing the form in the portal, select Tax Exempt Organization. When asked to upload a return at the end, upload your most recent audited financials.

Please do not enter commas or dollar signs. A negative number or zero in the Tranche 2 box indicates that you WILL NOT receive funding in tranche 2.

Written by Brian Werfel on . Posted in Medicare, Reimbursement.

Updated April 24, 2020 at 9:40 pm | Register for AAA’s 4/27 webinar on this topic►

At 5 p.m. on Friday, April 24, 2020, the Department of Health and Human Services opened the online portal that health care providers and suppliers must use to submit their revenue information. This is a requirement to access the second $20 billion tranche of general allocation funding. Access the online portal►

In order to provide the required information, you will need the following information/documentation:

The portal will ask a series of questions to verify your identity and the identity of your organization. These include providing your TIN and the last six digits of the bank account to which the original tranche of relief funding was provided.

After completing the verification process, you will be asked to complete an attestation that you received the initial tranche of relief funding.

You will then be prompted to complete a short questionnaire that is used to apply for additional funding. The steps for completing that questionnaire are as follows:

AAA is aware of an issue that may affect governmental EMS organizations. Specifically, those governmental agencies that do not file federal tax returns may not be able to complete the final stage of the application, which asks you to upload a copy of your most recent tax return. The AAA has reached out to HHS to request guidance on how governmental organizations should complete the form. We will update our members as soon as we know anything different. Register for our May 4 COVID-19 Financial Resources for Governmental Providers webinar►

HHS indicated that it will allocate an undisclosed portion of the $29.6 billion in otherwise unallocated relief funding to reimburse healthcare providers and suppliers for COVID-related treatment of the uninsured. Please note that this allocation is only available for the reimbursement of emergency and non-emergency ground ambulance transports. Reimbursement will be available for COVID-related care furnished with dates of service on or after February 4, 2020. Payments will be made at the Medicare rates, subject to available funding. As a condition to receipt of funding, you must agree to accept HHS’ payment as payment-in-full, i.e., you may not balance bill the uninsured patient.

Yes. In order to be eligible for payments for the treatment of uninsured COVID patients, must enroll as a participant in the program. Enrollment must be done through an online portal that will open starting on April 27, 2020. Once open, the portal can be accessed at http://www.coviduninsuredclaim.hrsa.gov.

HHS has indicated that it will begin to accept claims for reimbursement for the treatment of the uninsured at some point in early May 2020.

FUNDING FOR TREATMENT OF UNINSURED COVID PATIENTS IS SUBJECTED TO AVAILABLE FUNDING, AND IS THEREFORE ON A FIRST-COME, FIRST-SERVED BASIS. IT IS EXPECTED THAT THESE FUNDS WILL BE EXHAUSTED IN FAIRLY SHORT ORDER.

The AAA strongly recommends that all members complete their enrollment form as soon as reasonably practicable, so that you are in a position to submit claims as soon as the claim submission window opens.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

HHS Announces Plans for Distribution of Remaining CARES Act Provider Relief Funding

By Brian S. Werfel, Esq.

March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

The Department of Health and Human Services (HHS) began the disbursement of the first $30 billion tranche of the CARES Act Provider Relief Funding on April 10, 2020, with full disbursement of this tranche being completed by April 17, 2020. The American Ambulance Association has issued a Frequently Asked Question that provides additional details on how the payments under this first tranche were calculated, as well as the terms and conditions that are applicable to this disbursement.

On April 22, 2020, HHS announced its plans for the disbursement of the remaining $70 billion in CARES Act Provider Relief Funding. These monies will be distributed using four broad categories:

Upcoming Important Dates

To participate in these future funding tranches, AAA Members will need to keep the following dates in mind:

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

Frequently Asked Questions (FAQs) related to HHS CARES Act Provider Relief Funding

By Brian S. Werfel, Esq.

In March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

On April 9, 2020, the Department of Health and Human Services (HHS) began the disbursement of the first $30 billion of this provider relief funding. This disbursement was made to all healthcare providers and suppliers that were enrolled in the Medicare Program, and who received Medicare Fee-for-Service reimbursements during Calendar Year 2019. For most ambulance providers and suppliers, these relief funds were automatically deposited into their bank accounts.

In this Frequently Asked Question (FAQ), the AAA will address some of the more common questions that have arisen with respect to the Cares Act Provider Relief Funds.

Question #1: My organization received relief funds through an ACH Transfer. Is there anything our organization needs to do?

Answer #1: Yes. Within thirty (30) days of receiving the payment, you must sign an attestation confirming your receipt of the provider relief funds. As part of that attestation, you must also agree to accept certain Terms and Conditions. The attestation can be signed electronically by clicking here.

Question #2: Am I required to accept these funds? What happens if I am not willing to accept the Terms and Conditions imposed on the receipt of these funds?

Answer #2: You are not obligated to accept the provider relief funds. The purpose of these funds was to provide healthcare providers and suppliers with an immediate cash infusion in order to assist them in paying for COVID-related expenses and/or to offset lost revenues attributable to the COVID-19 pandemic.

If you are not willing to abide by the Terms and Conditions associated with these funds, you must contact HHS within thirty (30) days of receipt of payment, and then return the full amount of the funds to HHS as instructed. The CARES Act Provider Relief Fund Payment Attestation Portal provides instructions on the steps involved in rejecting the funds. Please note that your failure to contact HHS within 30 days to arrange for the return of these funds will be deemed to be an acceptance of the Terms and Conditions.

Question #3: Our organization has elected to retain the provider relief funds. Are there any major restrictions on how we can use these funds?

Answer #3: Yes. In the Terms and Conditions, HHS has indicated that you must certify that the funds will only be used to prevent, prepare for, and respond to coronavirus. You are also required to certify that the funding will only be used for health-care related expenses and/or to offset lost revenues that are attributable to coronavirus.

You are specifically required to certify that you will not use the relief funding to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse.

While the language in the Terms and Conditions are somewhat ambiguous, the AAA interprets this to mean that you must certify that your organization’s operations have been impacted, in some way, by the national response to the coronavirus. The AAA further interprets this language as requiring that, on net, the coronavirus pandemic has had an adverse impact on either your operations (in terms of added costs) or your revenues (in terms of decreased revenues). At the present time, the AAA believes that most, if not all, of our members that are currently providing services in response to the coronavirus pandemic will meet this standard.

Note: one situation where a provider may not be eligible for provider relief funding would be a situation where the provider ceased operations prior to January 31, 2020. For example, a provider that ceased operations on December 31, 2019. Because the ambulance provider was paid for Medicare FFS services furnished in 2019, it may receive provider relief funding. However, if the organization’s operations ceased prior to the onset of the current state of emergency, it would not be able to meet the requirement that it provided diagnoses, testing, or care for individuals with possible or actual cases of COVID-19. In this situation, the ambulance provider would likely be obligated to reject the provider relief funding.

Question #4: Are there any other restrictions on our use of provider relief funding?

Answer #4: Yes. In addition to the restrictions discussed in Answer #3 above, you are also restricted from using the provider relief funding for any of the following purposes:

Question #5: How will HHS verify that the provider relief funding is being used for an appropriate purpose?

Answer #5: HHS will require all recipients of provider relief funding to submit reports “as the Secretary determines are needed to ensure compliance with the conditions imposed.” HHS indicated that it will provide future program instructions to recipients that specifies the form and content of these reports. Recipients will also be required to maintain appropriate records and cost documentation to substantiate how provider relief funds were spent, and to provide copies of such records to HHS upon request.

In addition, ambulance providers and suppliers that receive, in the aggregate, more than $150,000 in funds under the CARES Act, the Coronavirus Preparedness and Response Supplemental Appropriations Act, the Families First Coronavirus Response Act, and any other legislation that makes appropriations for coronavirus response and related activities will be required to submit a report within 10 days of the end of each calendar quarter. These reports must specify: (1) the total amount of funds received from HHS under each of these pieces of legislation, (2) the amount of funds received that was spent or obligated to be spend, and (3) a detailed list of all projects or activities for which large covered funds were expended or obligated.

Question #6: We understand that one of the conditions associated with the provider relief funding is that we agree not to balance bill patients. Is our understanding correct?

Answer #6: The Terms and Conditions do contain provisions that would likely place restrictions on your ability to balance-bill patients.

In order to understand these restrictions, it is probably helpful to understand the underlying purpose of the restriction. The actual language from the Terms and Conditions reads as follows:

“The Secretary has concluded that the COVID-19 public health emergency has caused many healthcare providers to have capacity constraints. As a result, patients that would ordinarily be able to choose to receive all care from in-network healthcare providers may no longer be able to receive such care in-network. Accordingly, for all care for a presumptive or actual case of COVID-19, Recipient certifies that it will not seek to collect from the patient out-of-pocket expenses in an amount greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network Recipient.”

As the language makes clear, HHS was not focused primarily on the practice of balance-billing. Rather, HHS’ concern was that many healthcare providers would have capacity restraints. As a result, patients may be restricted in their ability to receive care from their normal providers (who are presumably in-network with the patient’s insurer). HHS’ intent was to ensure that the patient does not suffer any adverse financial consequences as a result of seeking care for presumptive or actual cases of COVID-19. It accomplishes this goal by requiring the recipient of provider relief funds to agree not to collect from the patient out-of-pocket expenses that are greater than what the patient would have incurred has the care been provided by an in-network provider.

This is being interpreted as a ban on “balance-billing” because most commercial insurers require their contracted providers to accept the plan’s allowed amount as payment-in-full, i.e., to agree to only bill the patient for applicable copayments and deductibles.

Ambulance providers and suppliers should keep in mind that this will not impact the payment of claims from: (1) Medicare, Medicaid or other state and federal health care programs that already require you to accept the program’s allowed amount as payment-in-full, (2) commercial insurers with which the organization currently contracts, and (3) the uninsured. In other words, this requirement only impacts payments from commercial insurers with which the organization currently does not contract.

At this point in time, it is expected that non-contracted commercial insurers will process your claim and make a determination as to whether the claim is related to the treatment and care of a presumptive or actual case of COVID-19. If the plan determines that the services you furnished were COVID-related, they will likely pay you the in-network rate they have established with contracted providers in your services area. The plan will likely then issue a remittance notice that indicates that you may not bill the patient for any balance over the insurer’s payment. Note: many of the larger commercial insurers have indicated that they will waive the copayments and deductibles due from patients for COVID-related claims. If the plan waives the copayment and deductibles, they will pay these amounts to you as part of their payment of the claim. If they do not waive the copayment and deductible, you will be permitted to seek to collect these amounts from the patient. If the plan determines that the services you furnished were not COVID-related, they will continue to pay your claims using their normal claims processing, and you would be permitted to balance bill the patient to the extent otherwise permitted under state and local law.

There is still a good deal of confusion related to this aspect of the CARES Act Provider Relief Funding. It is expected that HHS will be issuing further clarification in the days to come. The AAA will update this FAQ to reflect any updated guidance from HHS.

Written by Akin Gump on . Posted in Emergency Preparedness, Legislative, Medicare, Regulatory.

Download materials from Akin Gump including aid summaries and how-to guides on qualifying for tax credits and deferments and applying for financial assistance.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

CMS Clarifies Medicare Requirements Related to Medical Necessity and the Patient Signature Requirement during Current National State of Emergency

By Brian S. Werfel, Esq.

On April 9, 2020, CMS updated its Frequently Asked Questions (FAQs) for billing Medicare Fee-For-Service Claims during the current national state of emergency. This document includes guidance for numerous industry types, including ambulance services. The ambulance-specific questions start on page 11.

Two of the more common questions that A.A.A. members have asked during the current crisis are:

CMS did provide some guidance on both of these issues.

CMS addressed the issue of medical necessity in its answer to Question #9 on page 13. The question posed to CMS was whether an ambulance provider/supplier could consider any COVID-19 positive patient to meet the medical necessity requirements for an ambulance. CMS responded as follows:

“Answer: The medical necessity requirements for coverage of ambulance services have not been changed. For both emergency and non-emergency ambulance transportation, Medicare pays for ground (land and water) and air ambulance transport services only if they are furnished to a Medicare beneficiary whose medical condition is such that other forms of transportation are contraindicated. The beneficiary’s condition must require both the ambulance transportation itself and the level of service provided for the billed services to be considered medically necessary.”

Basically, CMS declined to offer a blanket waiver of the medical necessity requirements for COVID-19 patients. In doing so, CMS seems to be suggesting that COVID-19 status, in and of itself, is not sufficient to establish Medicare coverage for an ambulance transport.

Fortunately, CMS did offer specific relief on the Medicare patient signature requirement. The question posed to CMS on page 16 (Question #14) was whether an ambulance provider/supplier could sign on the patient’s behalf to the extent the patient was known or suspected to be infected with COVID-19, and, as a result, asking the patient (or an authorized representative) to sign the Tablet would risk contaminating the device for future patients and/or ambulance personnel. CMS responded as follows:

“Answer: Yes, but only under specific, limited circumstances. CMS will accept the signature of the ambulance provider’s or supplier’s transport staff if that beneficiary or an authorized representative gives verbal consent. CMS has determined that there is good cause to accept transport staff signatures under these circumstances. See 42 CFR 424.36(e). CMS recommends that ambulance providers and suppliers follow the Centers for Disease Control’s Interim Guidance for Emergency Medical Services (EMS) Systems and 911 Public Safety Answering Points (PSAPs) for COVID-19 in the United States, which can be found at the following link: https://www.cdc.gov/coronavirus/2019-ncov/hcp/guidance-for-ems.html. This guidance includes general guidelines for cleaning or maintaining EMS transport vehicles and equipment after transporting a patient with known or suspected COVID-19. However, in cases where it would not be possible or practical (such as a difficult to clean surface) to disinfect the electronic device after being touched by a beneficiary with known or suspected COVID-19, documentation should note the verbal consent.”

Essentially, CMS is indicating that you can accept a patient’s verbal consent to the submission of a claim in lieu of a written signature. In these instances, CMS is indicating that the crew must clearly document that they have obtained the patient’s (or the authorized representative’s) verbal consent.

Written by Brian Werfel on . Posted in Advocacy Priorities, Finance, Government Affairs, Legislative, Medicare, Operations, Patient Care, Regulatory, Reimbursement.

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

On April 9, 2020, the Department of Health and Human Services (HHS) indicated that it would be disbursing the first $30 billion of relief funding to eligible providers and suppliers starting on April 10, 2020. This money will be disbursed via direct deposit into eligible providers and supplier bank accounts. Please note that these are outright payments, i.e., these are not loans that will need to be repaid.

HHS indicated that any healthcare provider or supplier that received Medicare Fee-For-Service reimbursements in 2019 will be eligible for the initial allocation. Payments to practices that are part of larger medical groups will be sent to the group’s central billing office (based on Medicare enrollment information). HHS indicated that billing organizations will be identified by their Taxpayer Identification Numbers (TINs).

Yes. As a condition to receiving relief funding, a healthcare provider or supplier must agree not to seek to collection out-of-pocket payments from COVID-19 patients that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.

HHS indicated that the amounts healthcare providers and suppliers will receive will be based on their pro-rata share of total Medicare FFS expenditures in 2019. HHS indicated that Medicare FFS payments totaled $484 billion in 2019.

Providers and suppliers can estimate their initial relief payment amount by dividing their 2019 Medicare FFS reimbursement by $484 billion, and then multiplying that “ratio” by $30 billion. Note: payments from Medicare Advantage plans are not included in the calculation of a provider’s/supplier’s total 2019 Medicare payments.

As an example, HHS cited a community hospital that received $121 million in Medicare payments in 2019. HHS indicated that this hospital’s ratio would be 0.00025. That amount is then multiplied by $30 billion to come up with its initial relief fund payment of $7.5 million.

The AAA has created a CARES Act Provider Relief Calculator

that you can use to estimate your initial relief payment. |

USE DOWNLOADABLE EXCEL CALCULATOR►

No. You do not need to do anything to receive your relief funding. HHS has partnered with UnitedHealth Group (UHG) to disburse these monies using the Automated Clearing House (ACH) system. Payments will be made automatically to the ACH account information on file with UHG or CMS.

Providers and suppliers that are normally paid by CMS through paper checks will receive a check from CMS within the next few weeks.

The ACH deposit will come to you via Optum Bank. The payment description will read “HHSPayment.”

Yes. You will need to sign an attestation statement confirming relief of the funds within 30 days. These attestations will be made through a webportal that HHS anticipates opening the week of April 13, 2020. The portal will need to be accessed through the CARES Act Provider Relief Fund webpage, which can be accessed by clicking here.

You will also be required to accept the Terms and Conditions within 30 days. Providers and suppliers that do not wish to accept these terms and conditions are required to notify HHS within 30 days, and then remit full repayment of the relief funds. The Terms and Conditions can be reviewed by clicking here.

HHS has indicated that it intends to use the remaining relief funds to make targeted distributions to providers in areas particularly impacted by the COVID-19 outbreak, rural providers, providers of services with lower shares of Medicare reimbursement or who predominantly serve Medicaid populations, and providers requesting reimbursement for the treatment of uninsured Americans.

Written by Brian Werfel on . Posted in Medicare, Operations, Patient Care, Regulatory, Reimbursement.

On April 8, 2020, the Centers for Medicare and Medicaid Services (CMS) announced that it will be delaying the start of the Emergency Triage, Treat and Transport (ET3) Model until Fall 2020. The ET3 Model was previously set to start on May 1, 2020. CMS cited the national response to the COVID-19 pandemic as the reason for this delay.

In its delay notice, CMS also reminded the EMS industry that it has issued a number of temporary regulatory waivers and new rules that are designed to give health care providers and suppliers maximum flexibility to respond to the current national emergency. This includes a number of flexibilities offered specifically to the ambulance industry.

Written by Brian Werfel on . Posted in Finance, Reimbursement.

AAA Operations & Human Resources Consultant Scott Moore, Esq has developed a summary of financial relief provisions from the recent CARES Act. The resource will help your organization evaluate in which programs it may qualify to participate.