HRSA | Federal Office of Rural Health Policy Update | May 13, 2021

What’s New

CDC and USDA Team Up for Vaccine Education Effort. The Centers for Disease Control and Prevention (CDC) is providing $9.95 million in funding to the U.S. Department of Agriculture’s USDA) National Institute of Food and Agriculture (NIFA) to improve vaccine confidence in rural areas. NIFA will work with local partners through the Land Grant University System and its Cooperative Extension System, a nationwide educational network that provides non-formal higher education and learning to farming communities.

HRSA COVID-19 Coverage Assistance Fund. The Health Resources and Services Administration (HRSA) will provide claims reimbursement at the national Medicare rate for eligible health care providers administering vaccines to underinsured individuals. This may be particularly helpful in rural communities given higher rates of uninsured and underinsured.

HHS/DoD National Emergency Tele-Critical Care Network. A joint program of the U.S. Department of Health & Human Services (HHS) and the U.S. Department of Defense (DoD) is available at no cost to hospitals caring for COVID-19 patients and struggling with access to enough critical care physicians, nurses, respiratory therapists and other specialized clinical experts. Teams of critical care clinicians are available to deliver virtual care through lightweight telemedicine platforms, such as an app on a mobile device. Hear from participating clinicians and email to learn more and sign up.

HHS Coordinates New Effort to Vaccinate Migratory/Seasonal Workers in Agriculture. The U.S. Department of Health & Human Services (HHS) is working with several divisions, including the Food and Drug Administration and the Health Resources and Services Administration to boost vaccination rates in a workforce often at heightened risk of COVID-19 infection.

RAND/RWJF Report: COVID-19 and the Experiences of Populations at Greater Risk. The RAND Corporation joined with the Robert Wood Johnson Foundation (RWJF) to examine the way people view health issues. Researchers asked people in the United States about their experiences related to the pandemic, and their views on issues such as freedom, racism, and the role of government.

COVID-19 Resources

New: FCC Emergency Broadband Benefit Program. The Federal Communications Commission (FCC) created this temporary program to help eligible individuals and households afford internet service during the pandemic. Eligible households can enroll through an approved broadband service provider or by visiting GetEmergencyBroadband.org. The program will end when the fund runs out of money, or six months after the U.S. Department of Health and Human Services declares an end to the COVID-19 health emergency, whichever is sooner.

We Can Do This: COVID-19 Public Education Campaign. The U.S. Department of Health & Human Services announced a national effort to help community partners promote COVID-19 vaccine confidence. The campaign includes educational materials targeted to specific audiences and seeks volunteers for the COVID-19 Community Corps. New: The Rural Communities Toolkit provides resources for building vaccine confidence.

Volunteer to Administer COVID-19 Vaccines. The U.S. Department of Health & Human Services has expanded its definition of persons authorized to give the vaccine. These include, among others, current and retired traditional and non-traditional health care professionals, and students in health care programs.

HHS Facts About COVID Care for the Uninsured. The U.S. Department of Health & Human Services (HHS) helps uninsured individuals find no-cost COVID-19 testing, treatment and vaccines. The HRSA Uninsured Program provides claims reimbursement to health care providers generally at Medicare rates for testing, treating, and administering vaccines to uninsured individuals, including undocumented immigrants. There are at-a-glance fact sheets for providers and for patients in English and Spanish.

Federal Office of Rural Health Policy FAQs for COVID-19. A set of Frequently Asked Questions (FAQs) from our grantees and stakeholders. New: Resources for Rural Health Clinics.

COVID-19 FAQs and Funding for HRSA Programs. Find COVID-19-related funding and frequently asked questions for programs administered by the Health Resources and Services Administration (HRSA).

CARES Act Provider Relief Fund Frequently Asked Questions. Includes information on terms and conditions, attestation, reporting and auditing requirements, general and targeted distributions, and how to report capital equipment purchases.

CDC COVID-19 Updates. The Centers for Disease Control and Prevention (CDC) provides daily updates and guidance, including a section specific to rural health care, a vaccine locator by state, and COVID-19 Vaccination Trainings for new and experienced providers. New: Updated Frequently Asked Questions about COVID-19 vaccination, including new guidance for use in adolescents 12 and older.

CMS Coronavirus Partner Resources. The Centers for Medicare & Medicaid Services (CMS) provides information for providers, health plans, state Medicaid programs, and Children’s Health Insurance Programs and holds regular stakeholder calls to provide updates.

HHS Coronavirus Data Hub. The U.S. Department of Health & Human Services (HHS) website includes estimated and reported hospital capacity by state, with numbers updated daily.

NIH Community Engagement Alliance Against COVID-19 Disparities. The National Institutes of Health (NIH) created a collection of online resources with information for communities hit hardest by the pandemic, such as African Americans, Hispanics/Latinos, and American Indian/Alaska Natives.

COVID-19 Data from the U.S. Census Bureau. The site provides access to demographic and economic data, including state and local data on at-risk populations, poverty, health insurance coverage, and employment.

ATTC Network COVID-19 Resources for Addictions Treatment. The Addiction Technology Transfer Center (ATTC) Network was established in 1993 by the Substance Abuse and Mental Health Services Administration. The online catalog of COVID-related resources includes regularly-updated guidance and trainings for professionals in the field.

GHPC’s Collection of Rural Health Strategies for COVID-19. The FORHP-supported Georgia Health Policy Center (GHPC) provides reports, guidance, and innovative strategies gleaned from their technical assistance and peer learning sessions with FORHP grantees. New: The Impact of Rural Residence on COVID-19 Disparities.

Confirmed COVID-19 Cases, Metropolitan and Nonmetropolitan Counties. The RUPRI Center for Rural Health Policy Analysis provides up-to-date data on rural and urban confirmed cases throughout the United States. An animated map shows the progression of cases beginning March 26, 2020 to the present.

Rural Response to Coronavirus Disease 2019. The Rural Health Information Hub has a compendium of rural-specific activities and guidelines, including Rural Healthcare Surge Readiness, a tool with resources for responding to a local surge in cases.

SAMHSA Training and Technical Assistance Related to COVID-19. The Substance Abuse and Mental Health Services Administration (SAMHSA) created this list of resources, tools, and trainings for behavioral health and recovery providers.

Mobilizing Health Care Workforce via Telehealth. ProviderBridge.org was created by the Federation of State Medical Boards through the CARES Act and the FORHP-supported Licensure Portability Program. The site provides up-to-date information on emergency regulation and licensing by state as well as a provider portal to connect volunteer health care professionals to state agencies and health care entities.

Online Resource for Licensure of Health Professionals. Created by the Association of State and Provincial Psychology Boards, the site provides up-to-date information on emergency regulation and licensing in each state for psychologists, occupational therapists, physical therapists assistants, and social workers.

Funding and Opportunities

Nurse Corps Scholarship Program – extended to May 26. The Nurse Corps Scholarship Program provides financial support to students enrolled in nursing degree programs in exchange for a commitment to serve in high-need areas across the country. This year, Nurse Corps has additional funding for qualified nursing students that includes tuition, fees, other reasonable educational costs, and a monthly living stipend.

DOJ National Tribal Clearinghouse on Sexual Assault – June 3. The U.S. Department of Justice (DOJ) will make one award for $980,000 to an organization that can provide nationwide training and technical assistance for response to sexual assault crimes and services for victims in American Indian/Alaska Native communities.

DOJ Comprehensive Opioid, Stimulant, and Substance Abuse Site-Based Program – June 7. The U.S. Department of Justice (DOJ) will make 110 awards with total funding of $163 million to support state, local, tribal, and territorial response to use of illicit substances. A subcategory of the program will award up to $600,000 each for projects in rural areas, small counties, and tribal areas with a population of fewer than 100,000 for a federally recognized tribe.

HRSA Rural Northern Border Region Planning Program – June 14. The Health Resources and Services Administration’s (HRSA) will make approximately four awards of up to $190,000 each to support health care needs in underserved rural communities of the Northern Border Regional Commission (NBRC) service area.

DOJ Second Chance Act Youth Offender Reentry Program – June 15. The U.S. Department of Justice (DOJ) will make 13 awards of up to $750,000 each to support youth returning to their communities from correctional facilities. The program encourages collaboration between state agencies, local government, and community- and faith-based organizations. Separately, the DOJ will make approximately 15 awards of up to $750,000 each for the Juvenile Drug Treatment Court Program – June 15.

USDA Local Food Promotion Program – June 21. The U.S. Department of Agriculture (USDA) will make grants of up to $200,000 each for planning grants, and up to $750,000 for implementation grants. Grant recipients will create or expand projects that increase the availability of locally produced food.

DOJ Strategies to Support Children Exposed to Violence – June 22. The U.S. Department of Justice (DOJ) estimates eight awards with total investment of $7 million to support community-level strategies for children exposed to violence. Priority consideration will be given to applications promoting civil rights, building trust between law enforcement and the community, and that are intended to benefit high poverty areas.

HUD Housing Opportunities for Persons with AIDS – July 6. The U.S. Department of Housing and Urban Development (HUD) will make 18 awards of up to $2.25 million each for community projects that provide housing for people with HIV/AIDS in underserved areas. Rural populations are among those of interest for ensuring health equity. Also known as Housing as an Intervention to Fight AIDS, the program aims to create housing and service models that can be replicated in other similar localities.

Rural Health Research

Research in this section is provided by the HRSA/FORHP-supported Rural Health Research Gateway. Sign up to receive alerts when new publications become available.

Medicare-Paid Naloxone: Trends in Nonmetropolitan and Metropolitan Areas. Previous research has found that Medicare paid for an increasing share of naloxone prescriptions from 2016 to 2018 and pays for 1/3 of all naloxone dispensed from retail pharmacies as of 2018. This brief from the Rural and Underserved Health Research Center examines trends in Medicare-paid naloxone dispensing rates in nonmetropolitan versus metropolitan areas from 2014 to 2018.

Policy Updates

Visit the FORHP Policy page to see all recent updates and send questions to ruralpolicy@hrsa.gov.

Request for Information on Advancing Equity and Support for Underserved Communities – Comments due July 6. The Office of Management and Budget (OMB) seeks input from a broad array of stakeholders in the public, private, advocacy, not-for-profit, and philanthropic sectors, including State, local, Tribal, and territorial areas, on available methods, approaches, and tools that the Government can use to promote equity and support underserved communities.

Increased Medicare payment for COVID-19 monoclonal antibody infusions. The Centers and Medicare & Medicaid Service (CMS) announced last week an increase in the national average payment rate for administering monoclonal antibody treatments for COVID-19 from $310 to $450 for most health care settings. Additionally, they have established a higher national payment rate of $750 for monoclonal antibody treatments administered in a beneficiary’s home, including the beneficiary’s permanent residence or temporary lodging. CMS is updating its COVID-19 toolkits for providers, states, and insurers to reflect this change.

Medicare Guidance on Interoperability Rule Requirements for Hospitals. This interpretive guidance from the Centers for Medicare & Medicaid Services (CMS) outlines the Conditions of Participation (CoPs) requiring hospitals, psychiatric hospitals, and Critical Access Hospitals (CAHs) to send electronic patient event notifications of a patient’s admission, discharge, and/or transfer to another healthcare facility or to another community provider or practitioner, which are effective as of May 1, 2021. These CoPs were finalized in the May 2020 Interoperability and Patient Access Final Rule and are addressed in the recently released Interoperability Final Rule FAQs.

Medicare Waiver for Ambulance Treatment in Place. This Fact Sheet describes the circumstances in which ground ambulance services may be reimbursed by Medicare for treatment provided in place because a patient was not able to be transported to a destination permitted under Medicare regulations due to community-wide emergency medical service (EMS) protocols due to the COVID-19 PHE. This waiver is retroactively effective to March 1, 2020.

Learning Events and Technical Assistance

ONDCP Workshop for SUD: Rural Faith-Based Leaders – Thursday, May 13 at 1:00 pm ET. The Office of National Drug Control Policy (ONDCP) will hold a second session (90 minutes) in its series for faith leaders in rural areas. The workshops are meant to increase understanding of substance use disorder (SUD) and provide guidance on connecting faith to prevention, treatment, and recovery. If you would like to attend, please RSVP to Betty-Ann Bryce, Special Advisor for Rural Affairs at MBX.ONDCP.RuralAffairs@ondcp.eop.gov with your name, title, organization, state/county, and contact information/email address. The Rural Health Information Hub has a recording of the first workshop for faith leaders in its Community Toolbox for SUD.

MATRC: Answering Questions About Telehealth and Telemental Health – Friday, May 14 at 12:00 pm ET. The Mid-Atlantic Telehealth Resource Center (MATRC) holds a live, two-hour event to answer questions about the basics. The MATRC is one of 14 FORHP-Supported Telehealth Resource Centers. This is a recurring session taking place every other Friday from 12:00 to 2:00 pm ET.

HRSA Telehealth Series: Learn About Licensure Compacts – Monday, May 17 at 12:30 pm ET. Experts from the National Center for Interstate Compacts will discuss agreements for doctors, nurses, psychologists and other clinicians to see patients across state lines via telehealth.

SBIRT for SUD Native American Communities – Tuesday, May 18 at 11:00 am ET. Screening, Brief Intervention, and Referral to Treatment (SBIRT) is a process to quickly assess substance use disorder (SUD) in a person and move them toward more extensive treatment. This hour-long session is hosted by the National American Indian & Alaska Native Prevention Technology Transfer Center.

AgriSafe: Zoonotic Disease and Pregnancy – Wednesday, May 19 at 1:00 pm ET. The AgriSafe Network will hold a one-hour session to explain the risk that diseases transmitted between farm animals and humans pose to pregnant women.

Overcoming Mental Health Stigma in Rural Communities – Wednesday, May 19 at 2:00 pm ET. The Mental Health Technology Transfer Center Network will host a one-hour workshop to discuss what influences negative attitudes toward mental health and techniques to overcome various forms of stigma.

Assessment of Opioid Misuse Risk Among Farmers in the Clinical Setting – Friday, May 21 at 1:00 pm ET. The AgriSafe Network will host an hour-long webinar to provide insight on misuse risk factors and warning signs among farmers.

SAMHSA Connecting Prevention Specialists to Native Communities – Friday, May 21 at 1:00 pm ET. The Tribal Training and Technical Assistance Center at the Substance Abuse and Mental Health Services Administration (SAMHSA) holds virtual trainings to cover topics such as crisis response, youth engagement, and sexual assault awareness. Trainings will take place on the third Friday of each month.

Resource of the Week

Successful COVID-19 Messaging in Rural Communities. In this 30-minute video, the state leadership in West Virginia present insight from their research and vaccine outreach campaign.

Approaching Deadlines

CDC Childhood Lead Poisoning Prevention and Surveillance – extended to May 14 (from April 25)

Park and Recreation Mentorship Grants for Rural Youth Impacted by Opioids – May 15

ARC Investments Supporting Partnerships/Recovery Ecosystems – Letters of Intent May 17

CDC Drug Free Communities – extended to May 17 (from May 10)

Cross-Jurisdictional Sharing in Public Health: Small Grants Program – May 17

EPA Technical Assistance for Wastewater Treatment – May 17

SAMHSA Overdose Treatment for Use by First Responders – May 17

HRSA Expanding Community-Based Workforce for COVID-19 Vaccine Outreach – May 18

Comments Requested: Proposed Changes to the Census Bureau Definition of Urban – May 20

CMS Primary Care First Model Cohort 2 – extended to May 21 (from April 30)

CDC Community Health Workers for COVID Response – May 24

New Sites for National Health Service Corps (NHSC) – May 25

Native American Agriculture Fund Grants for Youth – May 25

Nurse Corps Scholarship Program – extended to May 26

Harris County Emergency Corps

Harris County Emergency Corps Year 2020 was a year like no other. The COVID-19 Pandemic affected every person globally, and we are still living in a world of mask-wearing and sanitizing stations.

Year 2020 was a year like no other. The COVID-19 Pandemic affected every person globally, and we are still living in a world of mask-wearing and sanitizing stations.

Waterbury Ambulance

Waterbury Ambulance Waterbury Ambulance also supports The Waterbury Backcountry Rescue Team which was founded in 2002, in order to lead the search and rescue of patients injured or lost in areas of Vermont where an ambulance is not able to readily access. Waterbury Backcountry Rescue Team is composed of a specially trained crew of rescuers and EMTs, who locate, extricate, and field treat patients, bringing them to an area which can be accessed by ambulance.

Waterbury Ambulance also supports The Waterbury Backcountry Rescue Team which was founded in 2002, in order to lead the search and rescue of patients injured or lost in areas of Vermont where an ambulance is not able to readily access. Waterbury Backcountry Rescue Team is composed of a specially trained crew of rescuers and EMTs, who locate, extricate, and field treat patients, bringing them to an area which can be accessed by ambulance. Covid-19 impacted Waterbury Ambulance by initially creating additional training and safety requirements. The team responded quickly ensuring that we provide the best possible care to our community during a scary time. The State of Vermont reached out to Waterbury Ambulance asking if we could support the state in Covid-19 testing. Waterbury Ambulance rose to the occasion by teaming up with two other ambulance services and a local ski patrol to provide testing 7 days a week at three different locations throughout our region. To date Waterbury Ambulance has provided tens of thousands of Covid-19 tests to the community. Waterbury Ambulance then hit the road providing vaccines to home-bound Vermonters. We have also helped the State of Vermont staff vaccine clinics and National Guard Clinics.

Covid-19 impacted Waterbury Ambulance by initially creating additional training and safety requirements. The team responded quickly ensuring that we provide the best possible care to our community during a scary time. The State of Vermont reached out to Waterbury Ambulance asking if we could support the state in Covid-19 testing. Waterbury Ambulance rose to the occasion by teaming up with two other ambulance services and a local ski patrol to provide testing 7 days a week at three different locations throughout our region. To date Waterbury Ambulance has provided tens of thousands of Covid-19 tests to the community. Waterbury Ambulance then hit the road providing vaccines to home-bound Vermonters. We have also helped the State of Vermont staff vaccine clinics and National Guard Clinics. “I believe that EMS is vital because we all need someone in our times of need to be that outside person to be kind, caring, and compassionate to our personal emergencies. Someone to validate our physical & emotional pain/suffering/ distress. Someone who you can trust with your life to get you the care you need, advocative for you, and ease your worries.” -Vicki Fielding, AEMT

“I believe that EMS is vital because we all need someone in our times of need to be that outside person to be kind, caring, and compassionate to our personal emergencies. Someone to validate our physical & emotional pain/suffering/ distress. Someone who you can trust with your life to get you the care you need, advocative for you, and ease your worries.” -Vicki Fielding, AEMT East Baton Rouge EMS

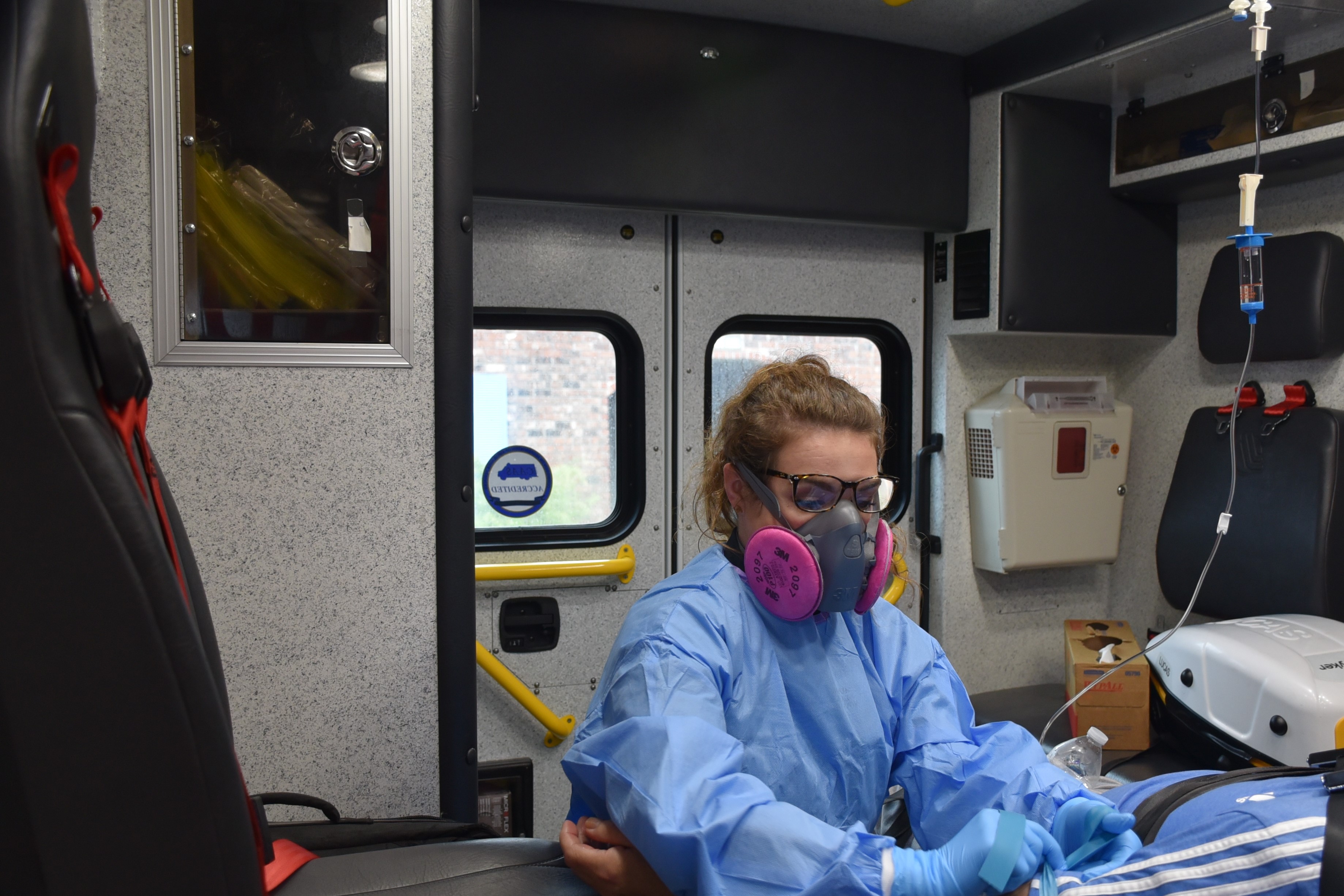

East Baton Rouge EMS A response plan to COVID was discussed in March 2020. The first order was to acquire enough PPE for our medics in the field. PPE included P-100 masks, goggles, and isolation kits. Two ambulances were converted into “COVID units” by using plastic sheeting to block the walk-through access of the units and the ALS cabinet. The units were stocked with an abundance of disinfectant and PPE. 12 medics volunteered to work on these units and only respond to COVID-related calls. The intention was to isolate the cab of the truck from the patient compartment, and limit exposure to the rest of the field by only using the assigned medics for these types of calls. 911 Operators began asking COVID screening questions, and would relay the information to the responding unit. Every patient was provided a surgical mask and the use of nebulizers was banned due to the aerosolization.

A response plan to COVID was discussed in March 2020. The first order was to acquire enough PPE for our medics in the field. PPE included P-100 masks, goggles, and isolation kits. Two ambulances were converted into “COVID units” by using plastic sheeting to block the walk-through access of the units and the ALS cabinet. The units were stocked with an abundance of disinfectant and PPE. 12 medics volunteered to work on these units and only respond to COVID-related calls. The intention was to isolate the cab of the truck from the patient compartment, and limit exposure to the rest of the field by only using the assigned medics for these types of calls. 911 Operators began asking COVID screening questions, and would relay the information to the responding unit. Every patient was provided a surgical mask and the use of nebulizers was banned due to the aerosolization.

St. Charles County Ambulance District

St. Charles County Ambulance District Over the past decade, SCCAD has developed and implemented a number of innovative initiatives to better meet the evolving healthcare needs of our community. These include a multi-faceted Mobile Integrated Health (community paramedic) program, which focuses on readmission avoidance in partnership with several hospitals in our area, and SCCAD high-utilization patients identified by our paramedics. In addition, the MIH team collaborates with commercial insurers to offer services to their patients in the county. Also developed in recent years was the American Ambulance Association AMBY award-winning Substance Use Recovery Response Team, which sees specially-trained paramedics helping facilitate overdose patients’ entry into treatment programs if they’re willing to seek help. In 2018, the District launched a successful behavioral health telemedicine program in partnership with Behavioral Health Response. Most recently, SCCAD was one of only three EMS organizations in the state of Missouri selected to pilot the Centers for Medicare & Medicaid Services Emergency Triage, Treat & Transport (ET3) program.

Over the past decade, SCCAD has developed and implemented a number of innovative initiatives to better meet the evolving healthcare needs of our community. These include a multi-faceted Mobile Integrated Health (community paramedic) program, which focuses on readmission avoidance in partnership with several hospitals in our area, and SCCAD high-utilization patients identified by our paramedics. In addition, the MIH team collaborates with commercial insurers to offer services to their patients in the county. Also developed in recent years was the American Ambulance Association AMBY award-winning Substance Use Recovery Response Team, which sees specially-trained paramedics helping facilitate overdose patients’ entry into treatment programs if they’re willing to seek help. In 2018, the District launched a successful behavioral health telemedicine program in partnership with Behavioral Health Response. Most recently, SCCAD was one of only three EMS organizations in the state of Missouri selected to pilot the Centers for Medicare & Medicaid Services Emergency Triage, Treat & Transport (ET3) program. In spring of last year, St. Charles County, like most other communities, struggled to scale up COVID-19 testing processes to meet demand. Residents experiencing symptoms were at times unable to get appointments for several days. Given the number of potential exposures that could result from a single infected paramedic, firefighter, or police officer, SCCAD’s MIH Team launched their first effort: a first responder testing program. The testing site enabled local police and fire agencies, along with SCCAD employees, to obtain a testing appointment in an expedited fashion. When local partners added more testing capacity toward autumn, we were able to scale down the testing effort.

In spring of last year, St. Charles County, like most other communities, struggled to scale up COVID-19 testing processes to meet demand. Residents experiencing symptoms were at times unable to get appointments for several days. Given the number of potential exposures that could result from a single infected paramedic, firefighter, or police officer, SCCAD’s MIH Team launched their first effort: a first responder testing program. The testing site enabled local police and fire agencies, along with SCCAD employees, to obtain a testing appointment in an expedited fashion. When local partners added more testing capacity toward autumn, we were able to scale down the testing effort.