CMMI Contractor Issues Final Report on Prior Authorization

Please either or Join!

Written by Brian Werfel on . Posted in Executive, Finance, Government Affairs, Legislative, Regulatory.

Written by Brian Werfel on . Posted in Finance, Medicare, Member Advisories, Member-Only, Regulatory, Reimbursement.

Written by Kathy Lester on . Posted in Advocacy Priorities, Executive, Finance, Government Affairs, Regulatory.

Written by Tristan North on . Posted in Advocacy Priorities, Finance, Legislative, Regulatory.

Written by Akin Gump on . Posted in Finance, Operations.

Written by Kathy Lester on . Posted in Advocacy Priorities, Executive, Finance, Legislative, Regulatory.

by Kathy Lester, J.D., M.P.H.

As the American Ambulance Association (AAA) reported yesterday, President Trump issued an Executive Order (EO) “An America-First Healthcare Plan.” The EO includes several provisions, including related to drug importation generally and for insulin specifically. It also includes statements that indicate if the Congress does not act before the end of the year, the President will have the Department of Health and Human Services (HHS) “take administrative action to prevent a patient from receiving a bill for out-of-pocket expenses that the patient could not have reasonably foreseen.” It does not mention ground ambulances.

In addition to suggesting action if the Congress does not pass legislation, the EO also states that within 180 days, the Secretary will update the Medicare.gov Hospital Compare website to inform beneficiaries of hospital billing quality, including:

The narrative related to balance billing (surprise coverage) reads as follows:

My Administration is transforming the black-box hospital and insurance pricing systems to be transparent about price and quality. Regardless of health-insurance coverage, two‑thirds of adults in America still worry about the threat of unexpected medical bills. This fear is the result of a system under which individuals and employers are unable to see how insurance companies, pharmacy benefit managers, insurance brokers, and providers are or will be paid. One major culprit is the practice of “surprise billing,” in which a patient receives unexpected bills at highly inflated prices from providers who are not part of the patient’s insurance network, even if the patient was treated at a hospital that was part of the patient’s network. Patients can receive these bills despite having no opportunity to select around an out-of-network provider in advance.

On May 9, 2019, I announced four principles to guide congressional efforts to prohibit exorbitant bills resulting from patients’ accidentally or unknowingly receiving services from out-of-network physicians. Unfortunately, the Congress has failed to act, and patients remain vulnerable to surprise billing.

In the absence of congressional action, my Administration has already taken strong and decisive action to make healthcare prices more transparent. On June 24, 2019, I signed Executive Order 13877 (Improving Price and Quality Transparency in American Healthcare to Put Patients First), directing certain agencies — for the first time ever — to make sure patients have access to meaningful price and quality information prior to the delivery of care. Beginning January 1, 2021, hospitals will be required to publish their real price for every service, and publicly display in a consumer-friendly, easy-to-understand format the prices of at least 300 different common services that are able to be shopped for in advance.

We have also taken some concrete steps to eliminate surprise out‑of-network bills. For example, on April 10, 2020, my Administration required providers to certify, as a condition of receiving supplemental COVID-19 funding, that they would not seek to collect out-of-pocket expenses from a patient for treatment related to COVID-19 in an amount greater than what the patient would have otherwise been required to pay for care by an in-network provider. These initiatives have made important progress, although additional efforts are necessary.

Not all hospitals allow for surprise bills. But many do. Unfortunately, surprise billing has become sufficiently pervasive that the fear of receiving a surprise bill may dissuade patients from seeking appropriate care. And research suggests a correlation between hospitals that frequently allow surprise billing and increases in hospital admissions and imaging procedures, putting patients at risk of receiving unnecessary services, which can lead to physical harm and threatens the long-term financial sustainability of Medicare.

Efforts to limit surprise billing and increase the number of providers participating in the same insurance network as the hospital in which they work would correspondingly streamline the ability of patients to receive care and reduce time spent on billing disputes.

The AAA will continue to advocate for the resources necessary to sustain life-saving mobile healthcare.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

Section 1834(l)(3)(B) of the Social Security Act mandates that the Medicare Ambulance Fee Schedule be updated each year to reflect inflation. This update is referred to as the “Ambulance Inflation Factor” or “AIF”.

The AIF is calculated by measuring the increase in the consumer price index for all urban consumers (CPI-U) for the 12-month period ending with June of the previous year. Starting in calendar year 2011, the change in the CPI-U is now reduced by a so-called “productivity adjustment”, which is equal to the 10-year moving average of changes in the economy-wide private nonfarm business multi-factor productivity index (MFP). The MFP reduction may result in a negative AIF for any calendar year. The resulting AIF is then added to the conversion factor used to calculate Medicare payments under the Ambulance Fee Schedule.

For the 12-month period ending in June 2020, the federal Bureau of Labor Statistics (BLS) has calculated that the CPI-U has increased by 0.646%.

Cautionary Note Regarding CPI-U. Members should be advised that the BLS’ calculations of the CPI-U are preliminary, and may be subject to later adjustment. Therefore, it is possible that these numbers may change.

CMS has yet to release its estimate for the MFP for calendar year 2021. Since its inception, this number has fluctuated between 0.3% and 1.2%. For calendar year 2020, the MFP was 0.7%. Under normal circumstances, it would be reasonable to expect the 2021 MFP to be within a percentage point or two of the 2020 MFP. However, the economic impact of the COVID-19 pandemic makes predictions on the MFP difficult at this point.

Accordingly, the AAA is not in a position to confidently project the 2021 Ambulance Inflation Factor at this point in time. However, the relative low increase in the CPI-U strongly suggests that the 2021 Ambulance Inflation Factor will be significantly lower than last year’s increase of 0.9%.

The AAA will notify members once CMS issues a transmittal setting forth the official 2021 Ambulance Inflation Factor.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

American Ambulance Association Medicare Consultant Brian Werfel, Esq provides a brief update on the HHS COVID-19 Provider Relief Fund.

Written by Brian Werfel on . Posted in Finance, Medicaid, Medicare, News.

On July 7, 2020, CMS updated its Coronavirus Disease 2019 (COVID-19) Provider Burden Relief Frequently Asked Questions (FAQs). As part of this update, CMS indicated that it would resume several program integrity functions, starting on August 3, 2020. This includes pre-payment and post-payment medical reviews by its Medicare Administrative Contractors (MACs), the Supplemental Medical Review Contractor (SMRC), and the Recovery Audit Contractors (RACs). This also includes the resumption of the Prior Authorization Model for scheduled, repetitive non-emergency ambulance transports. These programs had been suspended by CMS in March in response to the COVID-19 pandemic.

Resumption of Medicare Fee-For-Service Medical Reviews

CMS suspended most Medicare FFS medical reviews on March 30, 2020. This included pre-payment medical reviews conducted by its MACs under the Targeted Probe and Educate program, as well as post-payment reviews by its MACs, the SMRC, and the RACs. CMS indicated that, given the importance of medical review activities to CMS’ program integrity efforts, it expects to discontinue its “enforcement discretion” beginning on August 3, 2020.

CMS indicated that providers selected for review should discuss any COVID-related hardships that might affect the provider’s ability to respond to the audit in a timely fashion with their contractor.

CMS further indicated that its contractors will be required to consider any waivers and flexibilities in place at the time of the dates of service of claims selected for future review.

Resumption of Prior Authorization Model

Under the Repetitive, Scheduled, Non-Emergent Ambulance Transport Prior Authorization Model, ground ambulance providers in affected states are required to seek and obtain prior authorization for the transportation of repetitive patients beyond the third round-trip in a 30-day period. The Prior Authorization Model is currently in place in Delaware, Maryland, New Jersey, North Carolina, Pennsylvania, South Carolina, Virginia, West Virginia, and the District of Columbia.

On March 29, 2020, CMS suspended certain claims processing requirements under the Prior Authorization Model. During this “pause,” claims for repetitive, scheduled, non-emergency transports were not be stopped for pre-payment review to the extent prior authorization had not been requested prior to the fourth round trip in a 30-day period. However, CMS continued to permit ambulance providers to submit prior authorization requests to their MACs.

CMS indicated that full model operations and pre-payment review would resume for repetitive, scheduled non-emergent ambulance transportation submitted in the model states on or after August 3, 2020. CMS stated that the MACs will be required to conduct postpayment review on claims that were subject to the model, and which were submitted and paid during the pause. CMS further indicated that it would work with the affected providers to develop a schedule for postpayment reviews that does not significantly increase the burden on providers.

CMS stated that claims that received a provision affirmation prior authorization review decision, and which were submitted with an affirmed Unique Tracking Number (UTN) will continue to be excluded from most future medical review.

Written by Brian Werfel on . Posted in Advocacy Priorities, Finance, Government Affairs, News.

On July 7, 2020, the Internal Revenue Service published a series of Frequently Asked Questions that address the taxation of payments to health care providers under the HHS Provider Relief Fund.

As part of the Coronavirus Aid, Relief and Economic Security Act (CARES Act), Congress appropriated $100 billion to reimburse eligible health care providers for health care-related expenses and/or lost revenue attributable to the COVID-19 pandemic. The Paycheck Protection Program and Health Care Enhancement Act appropriated an additional $75 billion to the Provider Relief Fund.

The first FAQ addressed the issue of taxation for for-profit health care providers. Specifically, the IRS was asked whether a for-profit health care provider is required to include HHS Provider Relief Fund payments in its calculation of “gross income” under Section 61 of the Internal Revenue Code (Code), or whether such payments were excluded from gross income as “qualified disaster relief payments” under Section 139 of the Code.

The IRS indicated that payment from the Provider Relief Fund do not qualify as qualified disaster relief payments under Section 139 of the Code. As a result, these payments are includible in the gross income of the entity. The IRS further indicated that this holds true even for businesses organized as sole proprietorships.

The second FAQ addressed the issue of taxation for tax-exempt organizations. The IRS indicated that health care providers that are exempt from federal income taxation under Section 501(a) would normally not be subject to tax on payments from the Provider Relief Fund. Notwithstanding this general rule, the IRS indicated that the payment may be subject to tax under Section 511 of the Code to the extent the payment is used to reimburse the provider for expenses or lost revenue attributable to an unrelated trade or business as defined in Section 513 of the Code.

The IRS FAQ can be viewed in its entirety by clicking here. Members are advised to discuss the issue of potential taxation of any relief funding they received with their tax professionals.

Written by Brian Werfel on . Posted in Finance, Medicare, Reimbursement.

On May 1, 2020, CMS updated its “COVID-19 Frequently Asked Questions (FAQs) on Medicare Fee-for-Service (FFS) Billing.” The full document can be viewed by clicking here.

In the updated FAQ, CMS answers three important questions related to ambulance vehicle and staffing requirements:

Written by Brian Werfel on . Posted in Finance, Medicare, Reimbursement.

The Department of Health and Human Services recently updated its guidance on the disbursement of provider relief funds under the CARES Act for the testing and treatment of the uninsured. Previously, HHS indicated that this allocation was only available for the reimbursement of emergency and non-emergency ground ambulance transportation. However, in its most recent update, HHS has removed the restriction that limited participation to ground ambulance providers and suppliers. The new guidance indicates that the relief funds are now available for all emergency ambulance transportation and non-emergency patient transfers via ambulance.

Thus, it appears that air and water ambulance providers and suppliers are now eligible to receive funding for the treatment of COVID-19 patients.

Is there anything my air or water ambulance organization needs to do to claim reimbursement for treatment of uninsured COVID patients?

Yes. In order to be eligible for payments for the treatment of uninsured COVID patients, you must enroll as a participant in the program. Enrollment must be done through an online portal that can be accessed at: http://www.coviduninsuredclaim.hrsa.gov.

Once my organization enrolls, when can we start submitting claims for reimbursement for treatment of uninsured COVID patients?

HHS has indicated that it will begin to accept claims for reimbursement for treatment of the uninsured on May 6, 2020.

FUNDING FOR TREATMENT OF UNINSURED COVID PATIENTS IS SUBJECTED TO AVAILABLE FUNDING, AND IS THEREFORE ON A FIRST-COME, FIRST-SERVED BASIS. IT IS EXPECTED THAT THESE FUNDS WILL BE EXHAUSTED IN FAIRLY SHORT ORDER.

Written by Amanda Riordan on . Posted in Finance, Reimbursement.

Use the American Ambulance Association’s simple form to estimate relief you may receive from the second tranche of HHS COVID-19 funding. Please note that not all providers will receive funds.

More information about this program as well as access to the form you must complete in the General Allocation Portal can be found on the HHS website.

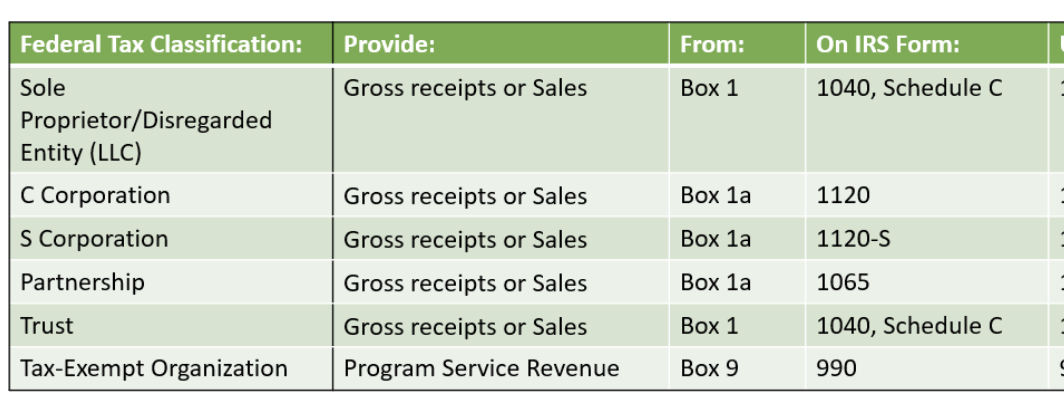

For-profit and non-profit non-governmental providers, to determine your Net Patient Revenue for the portal, use the following information from your most recently filed tax return. (2019 if filed, otherwise use 2018 numbers).

Governmental providers, enter your revenue generated for the last audited financial year. When completing the form in the portal, select Tax Exempt Organization. When asked to upload a return at the end, upload your most recent audited financials.

Please do not enter commas or dollar signs. A negative number or zero in the Tranche 2 box indicates that you WILL NOT receive funding in tranche 2.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

HHS Announces Plans for Distribution of Remaining CARES Act Provider Relief Funding

By Brian S. Werfel, Esq.

March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

The Department of Health and Human Services (HHS) began the disbursement of the first $30 billion tranche of the CARES Act Provider Relief Funding on April 10, 2020, with full disbursement of this tranche being completed by April 17, 2020. The American Ambulance Association has issued a Frequently Asked Question that provides additional details on how the payments under this first tranche were calculated, as well as the terms and conditions that are applicable to this disbursement.

On April 22, 2020, HHS announced its plans for the disbursement of the remaining $70 billion in CARES Act Provider Relief Funding. These monies will be distributed using four broad categories:

Upcoming Important Dates

To participate in these future funding tranches, AAA Members will need to keep the following dates in mind:

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

Frequently Asked Questions (FAQs) related to HHS CARES Act Provider Relief Funding

By Brian S. Werfel, Esq.

In March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

On April 9, 2020, the Department of Health and Human Services (HHS) began the disbursement of the first $30 billion of this provider relief funding. This disbursement was made to all healthcare providers and suppliers that were enrolled in the Medicare Program, and who received Medicare Fee-for-Service reimbursements during Calendar Year 2019. For most ambulance providers and suppliers, these relief funds were automatically deposited into their bank accounts.

In this Frequently Asked Question (FAQ), the AAA will address some of the more common questions that have arisen with respect to the Cares Act Provider Relief Funds.

Question #1: My organization received relief funds through an ACH Transfer. Is there anything our organization needs to do?

Answer #1: Yes. Within thirty (30) days of receiving the payment, you must sign an attestation confirming your receipt of the provider relief funds. As part of that attestation, you must also agree to accept certain Terms and Conditions. The attestation can be signed electronically by clicking here.

Question #2: Am I required to accept these funds? What happens if I am not willing to accept the Terms and Conditions imposed on the receipt of these funds?

Answer #2: You are not obligated to accept the provider relief funds. The purpose of these funds was to provide healthcare providers and suppliers with an immediate cash infusion in order to assist them in paying for COVID-related expenses and/or to offset lost revenues attributable to the COVID-19 pandemic.

If you are not willing to abide by the Terms and Conditions associated with these funds, you must contact HHS within thirty (30) days of receipt of payment, and then return the full amount of the funds to HHS as instructed. The CARES Act Provider Relief Fund Payment Attestation Portal provides instructions on the steps involved in rejecting the funds. Please note that your failure to contact HHS within 30 days to arrange for the return of these funds will be deemed to be an acceptance of the Terms and Conditions.

Question #3: Our organization has elected to retain the provider relief funds. Are there any major restrictions on how we can use these funds?

Answer #3: Yes. In the Terms and Conditions, HHS has indicated that you must certify that the funds will only be used to prevent, prepare for, and respond to coronavirus. You are also required to certify that the funding will only be used for health-care related expenses and/or to offset lost revenues that are attributable to coronavirus.

You are specifically required to certify that you will not use the relief funding to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse.

While the language in the Terms and Conditions are somewhat ambiguous, the AAA interprets this to mean that you must certify that your organization’s operations have been impacted, in some way, by the national response to the coronavirus. The AAA further interprets this language as requiring that, on net, the coronavirus pandemic has had an adverse impact on either your operations (in terms of added costs) or your revenues (in terms of decreased revenues). At the present time, the AAA believes that most, if not all, of our members that are currently providing services in response to the coronavirus pandemic will meet this standard.

Note: one situation where a provider may not be eligible for provider relief funding would be a situation where the provider ceased operations prior to January 31, 2020. For example, a provider that ceased operations on December 31, 2019. Because the ambulance provider was paid for Medicare FFS services furnished in 2019, it may receive provider relief funding. However, if the organization’s operations ceased prior to the onset of the current state of emergency, it would not be able to meet the requirement that it provided diagnoses, testing, or care for individuals with possible or actual cases of COVID-19. In this situation, the ambulance provider would likely be obligated to reject the provider relief funding.

Question #4: Are there any other restrictions on our use of provider relief funding?

Answer #4: Yes. In addition to the restrictions discussed in Answer #3 above, you are also restricted from using the provider relief funding for any of the following purposes:

Question #5: How will HHS verify that the provider relief funding is being used for an appropriate purpose?

Answer #5: HHS will require all recipients of provider relief funding to submit reports “as the Secretary determines are needed to ensure compliance with the conditions imposed.” HHS indicated that it will provide future program instructions to recipients that specifies the form and content of these reports. Recipients will also be required to maintain appropriate records and cost documentation to substantiate how provider relief funds were spent, and to provide copies of such records to HHS upon request.

In addition, ambulance providers and suppliers that receive, in the aggregate, more than $150,000 in funds under the CARES Act, the Coronavirus Preparedness and Response Supplemental Appropriations Act, the Families First Coronavirus Response Act, and any other legislation that makes appropriations for coronavirus response and related activities will be required to submit a report within 10 days of the end of each calendar quarter. These reports must specify: (1) the total amount of funds received from HHS under each of these pieces of legislation, (2) the amount of funds received that was spent or obligated to be spend, and (3) a detailed list of all projects or activities for which large covered funds were expended or obligated.

Question #6: We understand that one of the conditions associated with the provider relief funding is that we agree not to balance bill patients. Is our understanding correct?

Answer #6: The Terms and Conditions do contain provisions that would likely place restrictions on your ability to balance-bill patients.

In order to understand these restrictions, it is probably helpful to understand the underlying purpose of the restriction. The actual language from the Terms and Conditions reads as follows:

“The Secretary has concluded that the COVID-19 public health emergency has caused many healthcare providers to have capacity constraints. As a result, patients that would ordinarily be able to choose to receive all care from in-network healthcare providers may no longer be able to receive such care in-network. Accordingly, for all care for a presumptive or actual case of COVID-19, Recipient certifies that it will not seek to collect from the patient out-of-pocket expenses in an amount greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network Recipient.”

As the language makes clear, HHS was not focused primarily on the practice of balance-billing. Rather, HHS’ concern was that many healthcare providers would have capacity restraints. As a result, patients may be restricted in their ability to receive care from their normal providers (who are presumably in-network with the patient’s insurer). HHS’ intent was to ensure that the patient does not suffer any adverse financial consequences as a result of seeking care for presumptive or actual cases of COVID-19. It accomplishes this goal by requiring the recipient of provider relief funds to agree not to collect from the patient out-of-pocket expenses that are greater than what the patient would have incurred has the care been provided by an in-network provider.

This is being interpreted as a ban on “balance-billing” because most commercial insurers require their contracted providers to accept the plan’s allowed amount as payment-in-full, i.e., to agree to only bill the patient for applicable copayments and deductibles.

Ambulance providers and suppliers should keep in mind that this will not impact the payment of claims from: (1) Medicare, Medicaid or other state and federal health care programs that already require you to accept the program’s allowed amount as payment-in-full, (2) commercial insurers with which the organization currently contracts, and (3) the uninsured. In other words, this requirement only impacts payments from commercial insurers with which the organization currently does not contract.

At this point in time, it is expected that non-contracted commercial insurers will process your claim and make a determination as to whether the claim is related to the treatment and care of a presumptive or actual case of COVID-19. If the plan determines that the services you furnished were COVID-related, they will likely pay you the in-network rate they have established with contracted providers in your services area. The plan will likely then issue a remittance notice that indicates that you may not bill the patient for any balance over the insurer’s payment. Note: many of the larger commercial insurers have indicated that they will waive the copayments and deductibles due from patients for COVID-related claims. If the plan waives the copayment and deductibles, they will pay these amounts to you as part of their payment of the claim. If they do not waive the copayment and deductible, you will be permitted to seek to collect these amounts from the patient. If the plan determines that the services you furnished were not COVID-related, they will continue to pay your claims using their normal claims processing, and you would be permitted to balance bill the patient to the extent otherwise permitted under state and local law.

There is still a good deal of confusion related to this aspect of the CARES Act Provider Relief Funding. It is expected that HHS will be issuing further clarification in the days to come. The AAA will update this FAQ to reflect any updated guidance from HHS.

Written by Tristan North on . Posted in Finance, Human Resources, Legislative, Wages & Timekeeping.

The Department of Treasury has announced that the $350 billion appropriated under the CARES Act for the Paycheck Protection Program has been exhausted. However, Congressional leaders are currently negotiating an economic stimulus package to act as a bridge between the CARES Act and the next comprehensive package stimulus package. A core provision of the bridge package is an allocation of an additional $250 billion for the Paycheck Protection Program. If your operation is in the process or plans to apply for a loan under the Paycheck Protection Program, you should move forward with your efforts. The AAA is advocating that the bridge package or next comprehensive package include more funding for ambulance services.

Written by Brian Werfel on . Posted in Finance, Government Affairs, Medicare, Reimbursement.

CMS Clarifies Medicare Requirements Related to Medical Necessity and the Patient Signature Requirement during Current National State of Emergency

By Brian S. Werfel, Esq.

On April 9, 2020, CMS updated its Frequently Asked Questions (FAQs) for billing Medicare Fee-For-Service Claims during the current national state of emergency. This document includes guidance for numerous industry types, including ambulance services. The ambulance-specific questions start on page 11.

Two of the more common questions that A.A.A. members have asked during the current crisis are:

CMS did provide some guidance on both of these issues.

CMS addressed the issue of medical necessity in its answer to Question #9 on page 13. The question posed to CMS was whether an ambulance provider/supplier could consider any COVID-19 positive patient to meet the medical necessity requirements for an ambulance. CMS responded as follows:

“Answer: The medical necessity requirements for coverage of ambulance services have not been changed. For both emergency and non-emergency ambulance transportation, Medicare pays for ground (land and water) and air ambulance transport services only if they are furnished to a Medicare beneficiary whose medical condition is such that other forms of transportation are contraindicated. The beneficiary’s condition must require both the ambulance transportation itself and the level of service provided for the billed services to be considered medically necessary.”

Basically, CMS declined to offer a blanket waiver of the medical necessity requirements for COVID-19 patients. In doing so, CMS seems to be suggesting that COVID-19 status, in and of itself, is not sufficient to establish Medicare coverage for an ambulance transport.

Fortunately, CMS did offer specific relief on the Medicare patient signature requirement. The question posed to CMS on page 16 (Question #14) was whether an ambulance provider/supplier could sign on the patient’s behalf to the extent the patient was known or suspected to be infected with COVID-19, and, as a result, asking the patient (or an authorized representative) to sign the Tablet would risk contaminating the device for future patients and/or ambulance personnel. CMS responded as follows:

“Answer: Yes, but only under specific, limited circumstances. CMS will accept the signature of the ambulance provider’s or supplier’s transport staff if that beneficiary or an authorized representative gives verbal consent. CMS has determined that there is good cause to accept transport staff signatures under these circumstances. See 42 CFR 424.36(e). CMS recommends that ambulance providers and suppliers follow the Centers for Disease Control’s Interim Guidance for Emergency Medical Services (EMS) Systems and 911 Public Safety Answering Points (PSAPs) for COVID-19 in the United States, which can be found at the following link: https://www.cdc.gov/coronavirus/2019-ncov/hcp/guidance-for-ems.html. This guidance includes general guidelines for cleaning or maintaining EMS transport vehicles and equipment after transporting a patient with known or suspected COVID-19. However, in cases where it would not be possible or practical (such as a difficult to clean surface) to disinfect the electronic device after being touched by a beneficiary with known or suspected COVID-19, documentation should note the verbal consent.”

Essentially, CMS is indicating that you can accept a patient’s verbal consent to the submission of a claim in lieu of a written signature. In these instances, CMS is indicating that the crew must clearly document that they have obtained the patient’s (or the authorized representative’s) verbal consent.

Written by Brian Werfel on . Posted in Advocacy Priorities, Finance, Government Affairs, Legislative, Medicare, Operations, Patient Care, Regulatory, Reimbursement.

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

On April 9, 2020, the Department of Health and Human Services (HHS) indicated that it would be disbursing the first $30 billion of relief funding to eligible providers and suppliers starting on April 10, 2020. This money will be disbursed via direct deposit into eligible providers and supplier bank accounts. Please note that these are outright payments, i.e., these are not loans that will need to be repaid.

HHS indicated that any healthcare provider or supplier that received Medicare Fee-For-Service reimbursements in 2019 will be eligible for the initial allocation. Payments to practices that are part of larger medical groups will be sent to the group’s central billing office (based on Medicare enrollment information). HHS indicated that billing organizations will be identified by their Taxpayer Identification Numbers (TINs).

Yes. As a condition to receiving relief funding, a healthcare provider or supplier must agree not to seek to collection out-of-pocket payments from COVID-19 patients that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.

HHS indicated that the amounts healthcare providers and suppliers will receive will be based on their pro-rata share of total Medicare FFS expenditures in 2019. HHS indicated that Medicare FFS payments totaled $484 billion in 2019.

Providers and suppliers can estimate their initial relief payment amount by dividing their 2019 Medicare FFS reimbursement by $484 billion, and then multiplying that “ratio” by $30 billion. Note: payments from Medicare Advantage plans are not included in the calculation of a provider’s/supplier’s total 2019 Medicare payments.

As an example, HHS cited a community hospital that received $121 million in Medicare payments in 2019. HHS indicated that this hospital’s ratio would be 0.00025. That amount is then multiplied by $30 billion to come up with its initial relief fund payment of $7.5 million.

The AAA has created a CARES Act Provider Relief Calculator

that you can use to estimate your initial relief payment. |

USE DOWNLOADABLE EXCEL CALCULATOR►

No. You do not need to do anything to receive your relief funding. HHS has partnered with UnitedHealth Group (UHG) to disburse these monies using the Automated Clearing House (ACH) system. Payments will be made automatically to the ACH account information on file with UHG or CMS.

Providers and suppliers that are normally paid by CMS through paper checks will receive a check from CMS within the next few weeks.

The ACH deposit will come to you via Optum Bank. The payment description will read “HHSPayment.”

Yes. You will need to sign an attestation statement confirming relief of the funds within 30 days. These attestations will be made through a webportal that HHS anticipates opening the week of April 13, 2020. The portal will need to be accessed through the CARES Act Provider Relief Fund webpage, which can be accessed by clicking here.

You will also be required to accept the Terms and Conditions within 30 days. Providers and suppliers that do not wish to accept these terms and conditions are required to notify HHS within 30 days, and then remit full repayment of the relief funds. The Terms and Conditions can be reviewed by clicking here.

HHS has indicated that it intends to use the remaining relief funds to make targeted distributions to providers in areas particularly impacted by the COVID-19 outbreak, rural providers, providers of services with lower shares of Medicare reimbursement or who predominantly serve Medicaid populations, and providers requesting reimbursement for the treatment of uninsured Americans.

Written by Akin Gump on . Posted in Finance, Operations.

Section 1102 provides $349 billion for expedited individual loans up to $10 million through approved lenders that are guaranteed 100% by the U.S. government. The loan proceeds can be used to cover payroll support (such as employee salaries, paid sick or medical leave, insurance premiums) and mortgage, rent and utility payments incurred from February 15, 2020 through June 30, 2020.1 The maximum amount of a loan equals 2.5 months of average historical monthly payroll expenses, subject to certain exclusions.

On March 31, 2020, the Department of Treasury issued preliminary guidance regarding the imminent implementation of the Paycheck Protection Program (PPP). On April 2, 2020, the Small Business Administration (SBA) issued an interim final rule providing additional implementation guidelines and requirements for the PPP.

Small businesses and sole proprietorships started to apply for and receive PPP loans on April 3, 2020. Independent contractors and self-employed individuals can begin applying on April 10, 2020. The loans are first come, first served.

Benefits for Borrowers: Borrowers are eligible for loan forgiveness equal to the amount spent by the borrower during an 8-week period after the origination date of the loan on payroll costs, interest payment on any mortgage incurred prior to February 15, 2020, payment of rent on any lease in force prior to February 15, 2020, and payment on any utility for which service began before February 15, 2020. All borrower and lender fees, collateral and personal guarantee requirements are waived. The fixed interest rate is 1 percent and loan maturity is two years. No prepayment fees will be charged. Loan repayments can be deferred for six months.

Benefits for Lenders: Allows loans to be sold on the secondary market. Provides the regulatory capital risk weight of loans made under this program, and temporary relief from troubled debt restructuring (TDR) disclosures for loans that are deferred under this program. Lender compensation for servicing the loan is 5 percent for loans of not more than $350,000;

3 percent for loans of more than $350,000 and less than $2,000,000; and 1 percent for loans of not less than $2,000,000. Interim SBA regulations provide some protection for banks in the underwriting process.

The SBA lender list can be found at https://www.sba.gov/paycheckprotection/find.

SBA counts all individuals employed on a full-time, part-time or other basis, so this includes employees obtained from a temporary employee agency, professional employee organization or leasing arrangement. Contractors receiving IRS Form 1099 and volunteers are not considered employees.

The method for determining size includes the following principles:

The SBA’s affiliation rules substantially impact the ability of many entities to qualify for small business loans. On April 3, 2020, SBA issued an interim final rule (Affiliation IFR) about the applicability of affiliation rules at 13 C.F.R. §§ 121.103 and 121.301 to PPP loans. This supplements the SBA’s April 2 interim final rule.

The Affiliation IFR clarifies that SBA’s affiliation rules apply to all PPP applicants unless an exemption provided in the CARES Act applies. It also adds a new exemption, providing that affiliation rules do not apply to relationships of any church, faith-based organization, or entity that is based on religious teaching or belief. Affiliation rules a waived for:

Concerns and entities are affiliates of each other when one controls or has the power to control the other, or a third party or parties controls or has the power to control both. It does not matter whether control is exercised. SBA’s affiliation rules applicable to financial assistance programs, found at 13 C.F.R. §§ 121.103, provide that any of the following circumstances is sufficient to establish affiliation.

Eligible borrowers can seek a total loan amount equal to monthly average of payroll over the past 12 months, multiplied by 2.5. “Payroll costs” include salary, wages, commissions, cash tips, paid vacation or leave, insurance premiums and other group health care payments, allowance for separation or dismissal, paid retirement benefits and state or local taxes. The statute also allows a business to include the “sum of any compensation to or income of a sole proprietor that is a wage, commission, or income, net earnings from self-employment, or similar compensation” in payroll costs to the extent these amounts are in an amount that is not more than $100,000 in one year.

“Payroll costs” do not include individual compensation in excess of $100,000, certain taxes (including the employer’s share of the social security portion (6.2% of employee wages) and the Medicare portion (1.45% of employee wages) of payroll taxes known as Federal Insurance Contributions Act (FICA)) and ordinary income tax withholding, compensation paid to an employee if their place of residence is outside the United States and paid leave under the Families First Coronavirus Relief Act.

Example: An employer with total payroll costs of $12 million over the past 12 months is eligible for a PPP loan of $2.5 million ($1 million average monthly payroll cost x 2.5).

If you received an Economic Injury Disaster Loan (EIDL) between January 21, 2020 and April 3, 2020, you can add the outstanding amount of that loan (less the amount of any “advance” under a COVD-19 EIDL) to your calculated total (average monthly payroll cost x 2.5) for purposes of calculating your maximum loan amount.

Example: An employer calculated the $2.5 million amount in the above example, and also has an outstanding COVID-19 EIDL of $600,000, $100,000 of which was an advance. The employer is eligible for a PPP loan of $3 million ($2.5 million plus

$600,000, minus $100,000 advance).

Borrowers that were not in business between February 15, 2019 and June 30, 2019 can receive a loan amount equal to 2.5 times their average payroll costs between January 1, 2020 and February 29, 2020. Borrowers that have existing loans under certain SBA programs may be subject to different limits.

Lenders must consider whether the borrower was in operation before February 15, 2020 and had employees for whom the borrower paid salaries and payroll taxes, (or paid independent contractors under Form 1099-MISC). Borrowers also must make a good faith certification on the PPP application form that:

The PPP waives certain fees typically required for SBA loans, including those under Sections 18(A) and 23(A) of the statute. Applicants also do not need to certify that they are unable to obtain credit elsewhere, or provide a personal guarantee or collateral for a covered loan. However, loan proceeds received under PPP cannot be used for the same costs for which proceeds from a loan received through the Economic Disaster Loan Assistance Program are used.

Loan proceeds may only be used to pay: (1) payroll costs; (2) costs related to the continuation of group health care benefits during periods of paid sick, medical or family leave, and insurance premiums; (3) mortgage interest payments; (4) rent payments; (5) utility payments; (6) interest on any debt obligation incurred before the covered period; or (7) refinancing EIDL made between January 31, 2020 and April 3, 2020.

Loan amounts expended during the eight-week period following the loan origination will be forgiven, up to the total amount of the loan, if used for payroll costs (up to an annualized rate of

$100,000 per employee). In addition, up to 25 percent of the loan forgiveness amount may be attributable to qualifying non-payroll costs including: (1) interest on a mortgage obligation; (2) rent; or (3) covered utilities. The CARES Act provides an exception from the general rule that debt forgiveness is taxable, so that that amount of loan forgiveness will not be included in the borrower’s taxable income.

The forgiveness amount will be reduced if the employer reduces the number of full-time equivalent employees, or reduces employees’ salary and wages beyond a certain amount during the eight-week period.

First, the forgiven amount will be reduced by multiplying the amount of forgivable costs by:

*Seasonal employers must measure the average number of FTE employees for the period from February 15, 2019 to June 30, 2019.

Example: Borrower had average FTEs of 300 employees per month from February 15- June 30, 2019, and average FTEs of 250 employees per month from January 1- February 29, 2020. The borrower obtains a $2.5 million loan and uses all of the loan proceeds to pay for forgivable expenses. During the eight-week period following the loan, the borrower employ an average of 150 FTEs per month. Employer elects January 1-February 29, 2020 baseline period. Forgiveness on the loan is reduced as follows:

150 Covered Period FTEs / 250 Baseline Period FTEs = 0.6

$2.5 million x 0.6 = $1.5 million forgiven

*Remaining $1 million principal must be repaid at applicable interest rate over remaining term of loan

Second, the forgiven amount will be reduced by the amount of any reduction in total salary or wages during the eight weeks after origination that exceeds 25 percent of an employee’s total salary or wages during most recent full quarter during with the employee was employed.

Employees that earned annualized pay in excess of $100,000 in 2019 are not counted for these purposes.

Example: Borrower obtains a $2.5 million loan and uses all of the loan proceeds to pay for forgivable expenses. During the eight-week period following the loan, the borrower reduces pay of hourly employees by 50 percent, resulting in a total reduction in compensation of $1,500,000. The borrower also reduces the pay of its five officers, all of whom earn more than $100,000, by 50 percent. The reduction in officer pay produces a savings of $250,000. No reduction in FTEs occurs. Forgiveness on the loan is reduced as follows:

$2.5 million – $750,000 (comp. reduction in excess of 25 percent to employees earning less than $100,000) = $1.75 million forgiven

(Remaining $750,000 principal must be repaid at applicable interest rate over remaining term of loan)

Borrowers may “cure” reductions in FTEs or compensation for purposes of forgiveness in certain circumstances. Specifically, these reductions will not reduce the forgiveness amount if:

Borrowers must provide sufficient documentation to demonstrate compliance with these requirements, including: (1) payroll tax filings reported to the Internal Revenue Service; (2) state income, payroll and unemployment insurance filings; and (3) other documentation, including cancelled checks, receipts or account transcripts, to verify mortgage interest, rent and utility payments.

Borrowers also must certify that the amounts for which forgiveness is requested were used to retain employees and make covered mortgage interest, rent or utility payments.

SBA intends to issue additional guidance on the loan forgiveness provisions of the PPP loan.

Beginning on April 3, 2020, you can apply at any lending institution that is approved to participate in the Small Business Administration’s 7(a) lending program. Additionally, upon completion of the CARES Act Section 1102 Lender Agreement (SBA Form 3506), the following types of lenders will be “automatically qualified” to issue PPP loans provided they are not currently designated in Troubled Condition:

However, the $349 billion in funds may not still be available by the time additional qualified lenders submit the requisite Lender Agreement. You will not have to visit any government institution to apply for the loan. Applicants are eligible to apply for the PPP loan until June 30, 2020.

For eligibility purposes, lenders will not be determining eligibility-based repayment ability, but rather whether the business was operational on February 15, 2020 and had employees for whom it paid salaries and payroll taxes (or paid independent contractors).

Written by Akin Gump on . Posted in Finance, Operations.

Download PDF from Akin Gump – Five Steps to an SBA PPP Loan

If the answer to all of the questions above is “yes,” keep reading.

First, check your payroll records to see how much you paid in total over the past 12 months:

Second, take that total number, divide by 12, and multiply this result by 2.5. This is your loan amount. The loan cannot be more than $10 million.

You can use the loan proceeds to pay your employees, pay health insurance premiums, pay rent, pay utilities, and pay interest on any debts your business had before February 15, 2020.

If in the eight weeks after the loan is issued, the following is true, the loan will be entirely forgiven:

*If you are required to layoff employees or reduce payroll during the eight week period, only a portion of your loan may be forgiven. Any portion of the loan that must be paid back will be at an interest rate of 1.0 percent over a two year term with the first payment being deferred six months after such determination is made.

Any bank or credit union will be able to offer these loans, and most will. All you need to do to apply is go to them with proof you were in business on February 15, 2020 and provide evidence of your payroll expenses (as defined in Step 2) for the 12 months leading up to the application. You should be able to get a loan disbursed to you the same day. Deadline is June 30, 2020. Application can be found here: Paycheck Protection Program Application Form.

© 2020 Akin Gump Strauss Hauer & Feld LLP