CMS To Phase-In Expansion of Medicare Prior Authorization Model

Please either or Join!

Written by Kathy Lester on . Posted in Operations, Patient Care.

Written by Brian Werfel on . Posted in Operations, Patient Care.

Written by Brian Werfel on . Posted in Operations, Patient Care.

On October 8, 2020, the Centers for Medicare and Medicaid Services (CMS) issued a Fact Sheet setting forth the repayment terms for advances made under the Medicare Accelerated and Advance Payments Program (AAPP). These changes were mandated by the passage of the Continuing Appropriations Act, 2021 and Other Extensions Act, which was enacted on October 1, 2020.

Background

On March 28, 2020, CMS expanded the existing Accelerated and Advance Payments Program to provide relief to Medicare providers and suppliers that were experiencing cash flow disruptions as a result of the COVID-19 pandemic, and associated economic lockdowns. Under the AAPP, Medicare providers and suppliers were eligible to receive an advance of up to three months of their historic Medicare payments. These advances are structured as “loans,” and are required to be repaid through the offset of future Medicare payments.

CMS began accepting applications for Medicare advances in mid-March 2020, before ending the program in late April following the passage of the CARES Act. CMS ultimately approved more than 45,000 applications for advances totaling approximately $100 billion, before it suspended the program in late April 2020.

Under the pre-existing terms of the AAPP, repayment through offset was required to commence on the 121st day following the provider or supplier’s receipt of the advance funds. The program also called for a 100% offset until all advanced funds had been repaid.

Revised Payment Terms

Under the revised payment terms announced by CMS, providers and suppliers will not be subject to recoupment of their Medicare payments for a period of one year from the date they received their AAPP payment. Starting on the date that is one year from their receipt of the AAPP payment, repayment will be made out of the provider’s or supplier’s future Medicare payments. The schedule for such repayments will be as follows:

To the extent there remains an outstanding AAPP balance after that 17 month period (i.e., 29 months after the date the provider or supplier received its AAPP payment, the provider or supplier will receive a letter setting forth their remaining balance. The provider or supplier will have 30 days from the date of that letter to repay the AAPP balance in full. To the extent the AAPP balance is not repaid in full within that 30-day period, interest will begin to accrue on the unpaid balance at a rate of 4%, starting from the date of the letter.

Medicare providers and suppliers are also permitted to repay their accelerated or advance payments at any time by contacting their Medicare Administrative Contractor.

Written by Brian Werfel on . Posted in Operations, Patient Care.

On August 25, 2020, the Centers for Medicare and Medicaid Services (CMS) published an interim final rule with a comment period titled “Medicare and Medicaid Programs, Clinical Laboratory Improvement Amendments of 1988 (CLIA), and Patient Protection and Affordable Care Act; Additional Policy and Regulatory Revisions in Response to the COVID-19 Public Health Emergency.” The interim final rule sets forth a number of new requirements designed to limit the COVID-19 exposure and to prevent the spread of COVID-19 within nursing homes.

Specifically, the interim final rule requires skilled nursing and other long-term care facilities to test residents and staff for COVID-19. The frequency of such testing is based on the positivity rate in which the facility is located, and can require COVID-19 testing as frequently as twice per week. Regardless of the frequency of required COVID-19 tests, facilities must also screen all staff, residents, and persons entering the facility for the signs and symptoms of COVID-19.

These requirements extend to individuals that provide services to nursing homes under arrangements, including health care personnel rendering care to residents within the facility. In subsequent guidance, CMS clarified that these testing and screening requirements apply to EMS personnel and other health care providers that render care to residents within the facility. However, in that same guidance, CMS indicated that EMS personnel must be permitted to enter the facility provided that: (1) they are not subject to a work exclusion as a result of to an exposure to COVID-19 or (2) showing signs or symptoms of COVID-19 after being screened.” CMS further indicated that “EMS personnel do not need to be screened so they can attend to an emergency without delay.”

In plain terms, CMS has created an affirmative obligation on nursing homes to ensure that any individual that provides services under a contractual arrangement with the nursing home comply with these testing and screening requirements. CMS has expressly waived the screening requirements for EMS personnel responding to medical emergencies at a nursing home. However, CMS has not specifically addressed the testing and screening requirements applicable to EMS personnel responding to nursing homes in non-emergency situations.

The A.A.A. is aware that a handful of State Health Agencies have issued their own guidance on this issue. The A.A.A. is also aware that individual nursing homes have started to require proof that EMS personnel have been tested for COVID-19 prior to allowing these individuals to enter the nursing home in a non-emergency situation.

EMS agencies may already be subject to state and local testing mandates. EMS agencies may also have their own internal policies that require employees to be periodically tested for COVID-19. As a result, there exists the potential for conflict where these existing testing policies conflict with the testing requirements of your local nursing homes.

The A.A.A. has been engaged in an ongoing conversation with CMS on these issues since the issuance of the interim final rule in August. As part of that conversation, the A.A.A. pushed for the exclusion of EMS personnel from the screening requirement when responding to medical emergencies, which was included in the recent CMS guidance document. The A.A.A. also continues to push for additional funding for COVID-19 testing for EMS agencies. CMS has recognized that the frequent testing of health care workers is essential to reducing the spread of the novel coronavirus. CMS has allocated funding for these purposes to other industries, including hospitals and nursing homes. As front-line health care workers, EMS agencies should have similar access to testing funds. The A.A.A. will continue to push for funding equity for the EMS industry.

In the interim, we strongly encourage our members to work with their state associations and other stakeholders to advocate for reasonable rules related to testing on the state and local levels. To the extent the applicable state or local agency has determined the appropriate frequency for the testing of EMS personnel responding to medical emergencies, those rules should also apply to EMS personnel responding to scheduled transports and other non-emergencies that start or end at a nursing home. Requiring more frequent testing in these situations would impose an undue burden on EMS agencies that provide these services. More frequent testing may also prove counterproductive, as it may discourage EMS agencies that cannot meet these higher requirements from responding in these situations. We also encourage our members to continue to push for state and local funding for the testing of their employees.

Written by Kathy Lester on . Posted in Operations, Patient Care.

CMS Clarify in Guidance that EMS Personnel Are Not Required To Be Tested under Skilled Nursing Facility Testing Interim Final Rule

The Centers for Medicare & Medicaid Services (CMS) have issued guidance clarifying the types of personnel who are subject to the testing requirements when entering a Skilled Nursing Facility (SNF) in the Interim Final Rule with Comment (IFC) on Additional Policy and Regulatory Revisions in Response to the COVID– 19 Public Health Emergency. The new guidance memo states:

Entry of Health Care Workers and Other Providers of Services

Health care workers who are not employees of the facility but provide direct care to the facility’s residents, such as hospice workers, Emergency Medical Services (EMS) personnel, dialysis technicians, laboratory technicians, radiology technicians, social workers, clergy etc., must be permitted to come into the facility as long as they are not subject to a work exclusion due to an exposure to COVID-19 or show signs or symptoms of COVID-19 after being screened. We note that EMS personnel do not need to be screened so they can attend to an emergency without delay. We remind facilities that all staff, including individuals providing services under arrangement as well as volunteers, should adhere to the core principles of COVID-19 infection prevention and must comply with COVID-19 testing requirements.

CMS issued this guidance at the request of the American Ambulance Association (AAA) to address concerns our members had raised about some SNFs misinterpreting the requirements. The guidance is also consistent with AAA’s interpretation of the IFC. As we indicated in an earlier Member Advisory, the IFC requires SNFs to test certain individuals for COVID-19 before they enter the facility. Specifically, it applies to employees, consultants, and contractors of a skilled nursing facility (SNF). It does not apply to vendors, suppliers, attending physicians, family, or visitors. Providers, such as medical directors and hospice, that are under a contract or consultants to a SNF are subject to the rule. EMS personnel do not come within the scope of the IFC.

Even though the testing requirements of the IFC do not extend to ground ambulance services that do not have a contractual relationship with a SNF, the AAA supports the efforts of all of our members to follow the World Health Organization and Centers for Disease Control and Prevention Guidelines to have EMT and paramedics use full Personal Protective Equipment (PPE) when they are engaging with any patient, not only those in SNFs. We also want to recognize the best practices of many members who have worked with SNFs to establish outdoor locations where the SNF personnel, when possible, can bring a patient out of the building to transfer the patient to the ambulance. These and other examples of safe practices can help control the spread of COVID-19, which is the paramount concern.

Written by Amanda Riordan on . Posted in News, Operations, Press.

COVID-19 response platform will now direct resources to first responders facing wildfires, hurricanes and other catastrophes

September 15, 2020 – Frontline Impact Project is expanding its mission and will now also support heroes on the frontlines of major natural disasters including the Western wildfires and Hurricane Laura. The platform, which The KIND Foundation launched in partnership with dozens of companies in response to COVID-19, will activate its existing infrastructure to shepherd resources like meals, snacks, beverages and personal care items to first responders in need. The announcement comes after extraordinary displays of courage and sacrifice from the nation’s firefighters, paramedics and emergency volunteers.

“We started Frontline Impact Project to meet the needs of those on the frontlines of the COVID-19 pandemic. While this work will continue, we are cognizant of the many others risking their lives to keep us safe, particularly as peak wildfire and hurricane seasons approach,” says Michael Johnston, President of The KIND Foundation. “Thanks to the generosity of more than 60 companies, we’re set up to respond in real time and help take care of America’s heroes as they take care of us.”

As part of this expansion, Frontline Impact Project has initiated partnerships with two leading disaster response nonprofits, National Voluntary Organizations Active in Disaster (NVOAD) and Good360, to get donated items to workers across the Gulf Coast and Western United States.

“Non-profit staff and volunteers work tirelessly to serve survivors impacted by disaster. Frontline Impact Project’s commitment and efforts to supporting those serving on the frontlines of disasters across the country is a welcome addition to the disaster response community,” says Katherine Boatwright, Director of Operations, NVOAD.

Since April, Frontline Impact Project has matched more than 650 frontline institutions with companies that have products or services to donate. Available resources include food, beverages, personal care items, mental health services and virtual fitness classes. Together with its inaugural partner KIND, the project has donated nearly four million products to date.

“We were looking for a flexible and streamlined way to donate our products. Frontline Impact Project gives us the opportunity to scale our giving as the situation demands and reach a deserving audience whose needs are paramount but not always top of mind,” says Aaron Croutch, Executive Vice President, Lenny & Larry’s.

Kara Goldin, Founder and CEO of Hint, adds, “Now, more than ever, it’s critical that we support first responders and help keep them healthy and hydrated. Hint has donated water to hundreds of healthcare organizations and first responders across the country, and the Frontline Impact Project has made coordination with a number of those groups much easier.”

In addition to Lenny and Larry’s and Hint, a number of companies have signed on to support this effort, including Adrenaline Shoc Smart Energy; Belgian Boys; CLEAN Cause; Just the Cheese; Kabaki Tea; Kodiak Cakes; KIND; La Colombe; Neuro; Paunchy Elephant; RISE Brewing Co; ROWDY; Purely Elizabeth; and ZICO Coconut Water.

To submit a donation or make a request, visit www.frontlineimpact.org.

Written by Kathy Lester on . Posted in Operations, Patient Care.

Written by Kathy Lester on . Posted in Operations, Patient Care.

The Centers for Medicare & Medicaid Services (CMS) has announced that the first performance period for the Emergency Triage, Treat, and Transport (ET3) Model will begin on January 1, 2021. As we reported previously, CMS delayed the start of ET3 Model, consistent with its delaying or pausing other payment models, because of the COVID-19 public health emergency (PHE).

To start this effort, CMS has indicated that it will post a revised Participation Agreement (PA) to the ET3 Model Portal by mid-October 2020. Participants must upload signed PAs to the ET3 Model Portal by December 15, 2020. CMS will also post an Implementation Plan Template (IPT). Participants must submit their IPT CMS by November 15, 2020 to allow CMS to review and accept the IPT prior to beginning their participation in the Model.

CMS plans to provide additional guidance, including: an Orientation Overview fact sheet, Billing and Payment fact sheets, Model Participation During the PHE fact sheet, a Who’s Who fact sheet, and an ET3 Model Portal User Guide. These documents will be available to participants through the ET3 Model Portal during the next several weeks.

The re-engagement on the ET3 Model prior to the end of the PHE is something that the American Ambulance Association (AAA) has supported in discussions with CMS. While it does not address some of the gaps in reimbursement and treatment that our members are seeing nationwide, for those who are participating in the model, it will be an enormous benefit.

The AAA also continues to work with CMS to identify new models that will allow other ground ambulance providers and suppliers to participate in innovative models, even though there were not able to meet the ET3 participation requirements.

Written by Kathy Lester on . Posted in Operations, Patient Care.

The Centers for Medicare & Medicaid Services (CMS) has released printable version of the ground ambulance data collection instrument and an expanded FAQ. Both updated documents address some of the more common questions that CMS has heard over the past months, many of which the American Ambulance Association raised. Importantly, CMS announces through the FAQs the registration process will begin December 2021.

The topics covered in the FAQs include:

New FAQs

Question: Will the modification listed in the COVID-19 Emergency Declaration Blanket Waiver issued by CMS on May 15, 2020 allow ground ambulance organizations selected in year 1 the option to continue with their current data collection period that started in early 2020 or choose to select a new data collection period starting in 2021? [Added 7/31/2020]

Examples of Data Collection and Reporting Periods for a Ground Ambulance Organization with Accounting Period not based on a Calendar Year:

The same principles apply to similar cases, for example when the other entity is a hospital, non-profit organization, or other type of entity.

Written by Rob Lawrence on . Posted in Government Affairs, Operations, Patient Care, Press.

AAA Communications Chair Rob Lawrence shared his insights about recent EMS and fire association joint advocacy efforts in EMS1. Don’t miss the full article!

Last week, the AAA were approached, via EMS1, by U.S. News, a national publication represented by journalist Gaby Galvin, asking about COVID-19 as it affects the front lines, rates of infection and quarantine, and generally life on the street. This opportunity provided the chance to bring together three national organizations who are all working hard to represent their members, lobby Congress and highlight the challenges at the tip of the spear.

Written by Brian Werfel on . Posted in Advocacy Priorities, Finance, Government Affairs, Legislative, Medicare, Operations, Patient Care, Regulatory, Reimbursement.

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). As part of that Act, Congress allocated $100 billion to the creation of a “CARES Act Provider Relief Fund,” which will be used to support hospitals and other healthcare providers on the front lines of the nation’s coronavirus response. These funds will be used to fund healthcare-related expenses or to offset lost revenue attributable to COVID-10. These funds will also be used to ensure that uninsured Americans have access to testing a treatment for COVID-19. Collectively, this funding is referred to as the “CARES Act Provider Relief Fund.”

On April 9, 2020, the Department of Health and Human Services (HHS) indicated that it would be disbursing the first $30 billion of relief funding to eligible providers and suppliers starting on April 10, 2020. This money will be disbursed via direct deposit into eligible providers and supplier bank accounts. Please note that these are outright payments, i.e., these are not loans that will need to be repaid.

HHS indicated that any healthcare provider or supplier that received Medicare Fee-For-Service reimbursements in 2019 will be eligible for the initial allocation. Payments to practices that are part of larger medical groups will be sent to the group’s central billing office (based on Medicare enrollment information). HHS indicated that billing organizations will be identified by their Taxpayer Identification Numbers (TINs).

Yes. As a condition to receiving relief funding, a healthcare provider or supplier must agree not to seek to collection out-of-pocket payments from COVID-19 patients that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.

HHS indicated that the amounts healthcare providers and suppliers will receive will be based on their pro-rata share of total Medicare FFS expenditures in 2019. HHS indicated that Medicare FFS payments totaled $484 billion in 2019.

Providers and suppliers can estimate their initial relief payment amount by dividing their 2019 Medicare FFS reimbursement by $484 billion, and then multiplying that “ratio” by $30 billion. Note: payments from Medicare Advantage plans are not included in the calculation of a provider’s/supplier’s total 2019 Medicare payments.

As an example, HHS cited a community hospital that received $121 million in Medicare payments in 2019. HHS indicated that this hospital’s ratio would be 0.00025. That amount is then multiplied by $30 billion to come up with its initial relief fund payment of $7.5 million.

The AAA has created a CARES Act Provider Relief Calculator

that you can use to estimate your initial relief payment. |

USE DOWNLOADABLE EXCEL CALCULATOR►

No. You do not need to do anything to receive your relief funding. HHS has partnered with UnitedHealth Group (UHG) to disburse these monies using the Automated Clearing House (ACH) system. Payments will be made automatically to the ACH account information on file with UHG or CMS.

Providers and suppliers that are normally paid by CMS through paper checks will receive a check from CMS within the next few weeks.

The ACH deposit will come to you via Optum Bank. The payment description will read “HHSPayment.”

Yes. You will need to sign an attestation statement confirming relief of the funds within 30 days. These attestations will be made through a webportal that HHS anticipates opening the week of April 13, 2020. The portal will need to be accessed through the CARES Act Provider Relief Fund webpage, which can be accessed by clicking here.

You will also be required to accept the Terms and Conditions within 30 days. Providers and suppliers that do not wish to accept these terms and conditions are required to notify HHS within 30 days, and then remit full repayment of the relief funds. The Terms and Conditions can be reviewed by clicking here.

HHS has indicated that it intends to use the remaining relief funds to make targeted distributions to providers in areas particularly impacted by the COVID-19 outbreak, rural providers, providers of services with lower shares of Medicare reimbursement or who predominantly serve Medicaid populations, and providers requesting reimbursement for the treatment of uninsured Americans.

Written by Brian Werfel on . Posted in Medicare, Operations, Patient Care, Regulatory, Reimbursement.

On April 8, 2020, the Centers for Medicare and Medicaid Services (CMS) announced that it will be delaying the start of the Emergency Triage, Treat and Transport (ET3) Model until Fall 2020. The ET3 Model was previously set to start on May 1, 2020. CMS cited the national response to the COVID-19 pandemic as the reason for this delay.

In its delay notice, CMS also reminded the EMS industry that it has issued a number of temporary regulatory waivers and new rules that are designed to give health care providers and suppliers maximum flexibility to respond to the current national emergency. This includes a number of flexibilities offered specifically to the ambulance industry.

Written by Akin Gump on . Posted in Finance, Operations.

Section 1102 provides $349 billion for expedited individual loans up to $10 million through approved lenders that are guaranteed 100% by the U.S. government. The loan proceeds can be used to cover payroll support (such as employee salaries, paid sick or medical leave, insurance premiums) and mortgage, rent and utility payments incurred from February 15, 2020 through June 30, 2020.1 The maximum amount of a loan equals 2.5 months of average historical monthly payroll expenses, subject to certain exclusions.

On March 31, 2020, the Department of Treasury issued preliminary guidance regarding the imminent implementation of the Paycheck Protection Program (PPP). On April 2, 2020, the Small Business Administration (SBA) issued an interim final rule providing additional implementation guidelines and requirements for the PPP.

Small businesses and sole proprietorships started to apply for and receive PPP loans on April 3, 2020. Independent contractors and self-employed individuals can begin applying on April 10, 2020. The loans are first come, first served.

Benefits for Borrowers: Borrowers are eligible for loan forgiveness equal to the amount spent by the borrower during an 8-week period after the origination date of the loan on payroll costs, interest payment on any mortgage incurred prior to February 15, 2020, payment of rent on any lease in force prior to February 15, 2020, and payment on any utility for which service began before February 15, 2020. All borrower and lender fees, collateral and personal guarantee requirements are waived. The fixed interest rate is 1 percent and loan maturity is two years. No prepayment fees will be charged. Loan repayments can be deferred for six months.

Benefits for Lenders: Allows loans to be sold on the secondary market. Provides the regulatory capital risk weight of loans made under this program, and temporary relief from troubled debt restructuring (TDR) disclosures for loans that are deferred under this program. Lender compensation for servicing the loan is 5 percent for loans of not more than $350,000;

3 percent for loans of more than $350,000 and less than $2,000,000; and 1 percent for loans of not less than $2,000,000. Interim SBA regulations provide some protection for banks in the underwriting process.

The SBA lender list can be found at https://www.sba.gov/paycheckprotection/find.

SBA counts all individuals employed on a full-time, part-time or other basis, so this includes employees obtained from a temporary employee agency, professional employee organization or leasing arrangement. Contractors receiving IRS Form 1099 and volunteers are not considered employees.

The method for determining size includes the following principles:

The SBA’s affiliation rules substantially impact the ability of many entities to qualify for small business loans. On April 3, 2020, SBA issued an interim final rule (Affiliation IFR) about the applicability of affiliation rules at 13 C.F.R. §§ 121.103 and 121.301 to PPP loans. This supplements the SBA’s April 2 interim final rule.

The Affiliation IFR clarifies that SBA’s affiliation rules apply to all PPP applicants unless an exemption provided in the CARES Act applies. It also adds a new exemption, providing that affiliation rules do not apply to relationships of any church, faith-based organization, or entity that is based on religious teaching or belief. Affiliation rules a waived for:

Concerns and entities are affiliates of each other when one controls or has the power to control the other, or a third party or parties controls or has the power to control both. It does not matter whether control is exercised. SBA’s affiliation rules applicable to financial assistance programs, found at 13 C.F.R. §§ 121.103, provide that any of the following circumstances is sufficient to establish affiliation.

Eligible borrowers can seek a total loan amount equal to monthly average of payroll over the past 12 months, multiplied by 2.5. “Payroll costs” include salary, wages, commissions, cash tips, paid vacation or leave, insurance premiums and other group health care payments, allowance for separation or dismissal, paid retirement benefits and state or local taxes. The statute also allows a business to include the “sum of any compensation to or income of a sole proprietor that is a wage, commission, or income, net earnings from self-employment, or similar compensation” in payroll costs to the extent these amounts are in an amount that is not more than $100,000 in one year.

“Payroll costs” do not include individual compensation in excess of $100,000, certain taxes (including the employer’s share of the social security portion (6.2% of employee wages) and the Medicare portion (1.45% of employee wages) of payroll taxes known as Federal Insurance Contributions Act (FICA)) and ordinary income tax withholding, compensation paid to an employee if their place of residence is outside the United States and paid leave under the Families First Coronavirus Relief Act.

Example: An employer with total payroll costs of $12 million over the past 12 months is eligible for a PPP loan of $2.5 million ($1 million average monthly payroll cost x 2.5).

If you received an Economic Injury Disaster Loan (EIDL) between January 21, 2020 and April 3, 2020, you can add the outstanding amount of that loan (less the amount of any “advance” under a COVD-19 EIDL) to your calculated total (average monthly payroll cost x 2.5) for purposes of calculating your maximum loan amount.

Example: An employer calculated the $2.5 million amount in the above example, and also has an outstanding COVID-19 EIDL of $600,000, $100,000 of which was an advance. The employer is eligible for a PPP loan of $3 million ($2.5 million plus

$600,000, minus $100,000 advance).

Borrowers that were not in business between February 15, 2019 and June 30, 2019 can receive a loan amount equal to 2.5 times their average payroll costs between January 1, 2020 and February 29, 2020. Borrowers that have existing loans under certain SBA programs may be subject to different limits.

Lenders must consider whether the borrower was in operation before February 15, 2020 and had employees for whom the borrower paid salaries and payroll taxes, (or paid independent contractors under Form 1099-MISC). Borrowers also must make a good faith certification on the PPP application form that:

The PPP waives certain fees typically required for SBA loans, including those under Sections 18(A) and 23(A) of the statute. Applicants also do not need to certify that they are unable to obtain credit elsewhere, or provide a personal guarantee or collateral for a covered loan. However, loan proceeds received under PPP cannot be used for the same costs for which proceeds from a loan received through the Economic Disaster Loan Assistance Program are used.

Loan proceeds may only be used to pay: (1) payroll costs; (2) costs related to the continuation of group health care benefits during periods of paid sick, medical or family leave, and insurance premiums; (3) mortgage interest payments; (4) rent payments; (5) utility payments; (6) interest on any debt obligation incurred before the covered period; or (7) refinancing EIDL made between January 31, 2020 and April 3, 2020.

Loan amounts expended during the eight-week period following the loan origination will be forgiven, up to the total amount of the loan, if used for payroll costs (up to an annualized rate of

$100,000 per employee). In addition, up to 25 percent of the loan forgiveness amount may be attributable to qualifying non-payroll costs including: (1) interest on a mortgage obligation; (2) rent; or (3) covered utilities. The CARES Act provides an exception from the general rule that debt forgiveness is taxable, so that that amount of loan forgiveness will not be included in the borrower’s taxable income.

The forgiveness amount will be reduced if the employer reduces the number of full-time equivalent employees, or reduces employees’ salary and wages beyond a certain amount during the eight-week period.

First, the forgiven amount will be reduced by multiplying the amount of forgivable costs by:

*Seasonal employers must measure the average number of FTE employees for the period from February 15, 2019 to June 30, 2019.

Example: Borrower had average FTEs of 300 employees per month from February 15- June 30, 2019, and average FTEs of 250 employees per month from January 1- February 29, 2020. The borrower obtains a $2.5 million loan and uses all of the loan proceeds to pay for forgivable expenses. During the eight-week period following the loan, the borrower employ an average of 150 FTEs per month. Employer elects January 1-February 29, 2020 baseline period. Forgiveness on the loan is reduced as follows:

150 Covered Period FTEs / 250 Baseline Period FTEs = 0.6

$2.5 million x 0.6 = $1.5 million forgiven

*Remaining $1 million principal must be repaid at applicable interest rate over remaining term of loan

Second, the forgiven amount will be reduced by the amount of any reduction in total salary or wages during the eight weeks after origination that exceeds 25 percent of an employee’s total salary or wages during most recent full quarter during with the employee was employed.

Employees that earned annualized pay in excess of $100,000 in 2019 are not counted for these purposes.

Example: Borrower obtains a $2.5 million loan and uses all of the loan proceeds to pay for forgivable expenses. During the eight-week period following the loan, the borrower reduces pay of hourly employees by 50 percent, resulting in a total reduction in compensation of $1,500,000. The borrower also reduces the pay of its five officers, all of whom earn more than $100,000, by 50 percent. The reduction in officer pay produces a savings of $250,000. No reduction in FTEs occurs. Forgiveness on the loan is reduced as follows:

$2.5 million – $750,000 (comp. reduction in excess of 25 percent to employees earning less than $100,000) = $1.75 million forgiven

(Remaining $750,000 principal must be repaid at applicable interest rate over remaining term of loan)

Borrowers may “cure” reductions in FTEs or compensation for purposes of forgiveness in certain circumstances. Specifically, these reductions will not reduce the forgiveness amount if:

Borrowers must provide sufficient documentation to demonstrate compliance with these requirements, including: (1) payroll tax filings reported to the Internal Revenue Service; (2) state income, payroll and unemployment insurance filings; and (3) other documentation, including cancelled checks, receipts or account transcripts, to verify mortgage interest, rent and utility payments.

Borrowers also must certify that the amounts for which forgiveness is requested were used to retain employees and make covered mortgage interest, rent or utility payments.

SBA intends to issue additional guidance on the loan forgiveness provisions of the PPP loan.

Beginning on April 3, 2020, you can apply at any lending institution that is approved to participate in the Small Business Administration’s 7(a) lending program. Additionally, upon completion of the CARES Act Section 1102 Lender Agreement (SBA Form 3506), the following types of lenders will be “automatically qualified” to issue PPP loans provided they are not currently designated in Troubled Condition:

However, the $349 billion in funds may not still be available by the time additional qualified lenders submit the requisite Lender Agreement. You will not have to visit any government institution to apply for the loan. Applicants are eligible to apply for the PPP loan until June 30, 2020.

For eligibility purposes, lenders will not be determining eligibility-based repayment ability, but rather whether the business was operational on February 15, 2020 and had employees for whom it paid salaries and payroll taxes (or paid independent contractors).

Written by Akin Gump on . Posted in Finance, Operations.

Download PDF from Akin Gump – Five Steps to an SBA PPP Loan

If the answer to all of the questions above is “yes,” keep reading.

First, check your payroll records to see how much you paid in total over the past 12 months:

Second, take that total number, divide by 12, and multiply this result by 2.5. This is your loan amount. The loan cannot be more than $10 million.

You can use the loan proceeds to pay your employees, pay health insurance premiums, pay rent, pay utilities, and pay interest on any debts your business had before February 15, 2020.

If in the eight weeks after the loan is issued, the following is true, the loan will be entirely forgiven:

*If you are required to layoff employees or reduce payroll during the eight week period, only a portion of your loan may be forgiven. Any portion of the loan that must be paid back will be at an interest rate of 1.0 percent over a two year term with the first payment being deferred six months after such determination is made.

Any bank or credit union will be able to offer these loans, and most will. All you need to do to apply is go to them with proof you were in business on February 15, 2020 and provide evidence of your payroll expenses (as defined in Step 2) for the 12 months leading up to the application. You should be able to get a loan disbursed to you the same day. Deadline is June 30, 2020. Application can be found here: Paycheck Protection Program Application Form.

© 2020 Akin Gump Strauss Hauer & Feld LLP

Written by Amanda Riordan on . Posted in Operations, Patient Care.

Thank you to the thousands of EMS and fire professionals who joined our social media campaign to encourage Amazon Business to admit mobile healthcare providers into their new COVID-19 Store. In response to the collective voices of our profession, Amazon has updated their policy! Effective April 6, EMS and Fire will begin to be onboarded into the limited-access marketplace. To participate:

The store is a new venture, and the virtual shelves are in the process of being stocked. However, Amazon has assured us that they have tens of millions of units of PPE and supplies on rush order. We encourage you to set up your agency account and check back frequently for new item availability.

We hope that access to the COVID-19 supplies and Amazon’s legendary logistics and delivery expertise will assist ambulance services in meeting the needs of their communities during this challenging and stressful time.

Written by Amanda Riordan on . Posted in Operations, Patient Care, Professional Standards.

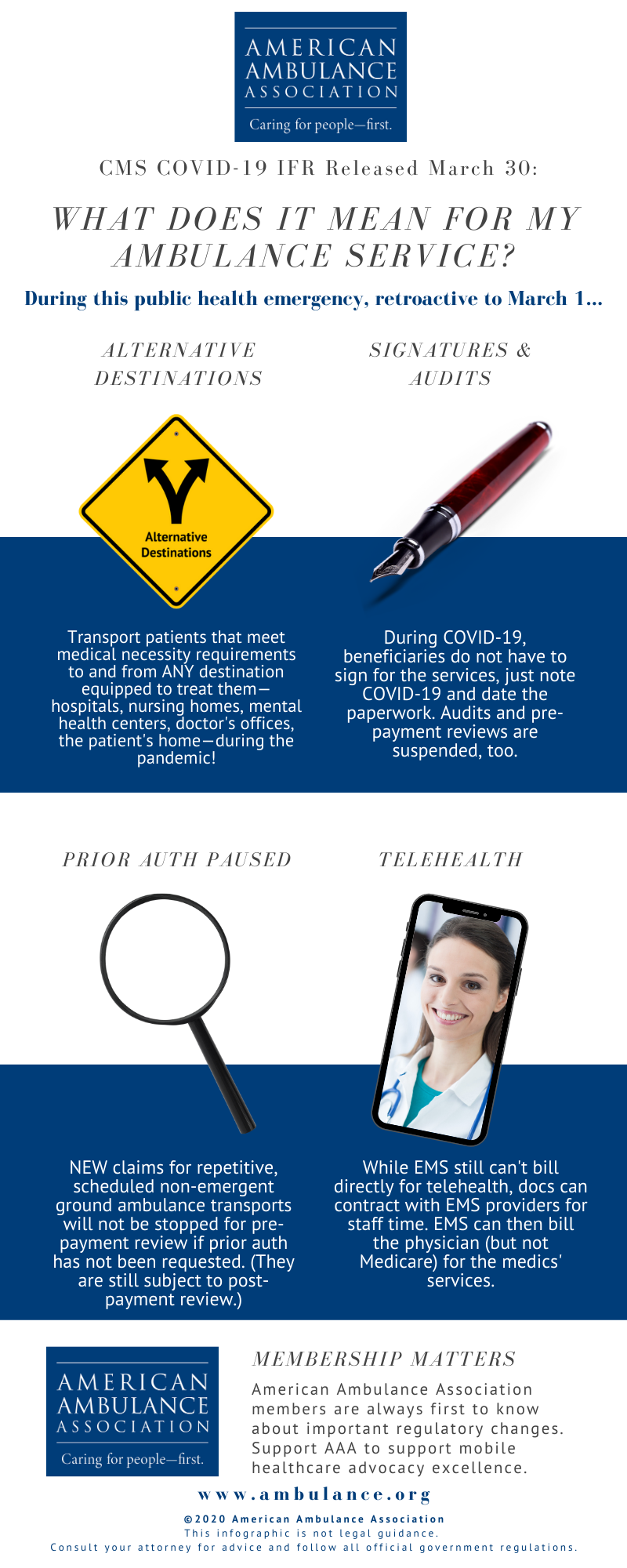

Looking for highlights from the new CMS IFR? See below for an infographic! (Members, read Kathy Lester, Esq.’s comprehensive summary.)

Written by Kathy Lester on . Posted in Government Affairs, Operations, Patient Care, Professional Standards, Regulatory.

The Centers for Medicare and Medicaid Services (CMS) promulgated an interim final rule with comment period (IFC) entitled “Policy and Regulatory Revisions in Response to the COVID-19 Public Health Emergency.” Consistent with the recommendations the AAA made to CMS, for the duration of the public health emergency (PHE), the IFC allows ground ambulance service providers and suppliers to transport patients both on an emergency or non-emergency basis to any destination that is equipped to treat the condition of the patient consistent with Emergency Medical Services (EMS) protocols established by state and/or local laws where the services will be furnished. In related guidance, CMS has suspended most Medicare Fee-For-Service (FFS) medical review during the emergency period due to the COVID-19 pandemic, waived patient signature requirements, and is pausing the Repetitive, Scheduled Non-Emergent Ambulance Transport Prior Authorization Model. The policies of the IFC are effective retroactively to March 1, 2020.

On March 11, the AAA sent CMS a letter specifically requesting for the agency to waive during the COVID-19 pandemic the regulatory restrictions that prevent coverage for transport to alternative destinations. Separately, the AAA has been pressing CMS to provide relief from signature requirements. The AAA had also been working with CMS to lifting of these restrictions and others to eliminate barriers the current Medicare regulations in responding to the COVID-19 crisis.

Paying for Transports to Alternative Destinations. During the duration of the crisis, CMS has expanded the list of destinations for which Medicare covers ambulance transportation to include all destinations, from any point of origin, that are equipped to treat the condition of the patient consistent with Emergency Medical Services (EMS) protocols established by state and/or local laws where the services will be furnished.

These destinations may include, but are not limited to: any location that is an alternative site determined to be part of a hospital, critical access hospital (CAH) or skilled nursing facility (SNF), community mental health centers, federal qualified health clinic (FQHCs), rural health clinics (RHCs), physicians’ offices, urgent care facilities, ambulatory surgery centers (ASCs), any location furnishing dialysis services outside of an ESRD facility when an ESRD facility is not available, and the beneficiary’s home.

This expanded list of destinations applies to medically necessary emergency and non-emergency ground ambulance transports of beneficiaries during the PHE for the COVID-19 pandemic. The IFC does not waive the medically necessary requirements for ground ambulance transport of a patient in order for an ambulance service to be covered.

The AAA is working closely with CMS to confirm that patients who require isolation meet the medical necessity requirements.

Suspension of Audits and Relief on Patient Signatures. In guidance released separately, CMS indicates that it is suspending nearly all audits of providers and suppliers for the duration of the PHE.

CMS has suspended most Medicare Fee-For-Service (FFS) medical review during the emergency period due to the COVID-19 pandemic. This includes pre-payment medical reviews conducted by Medicare Administrative Contractors (MACs) under the Targeted Probe and Educate program, and post-payment reviews conducted by the MACs, Supplemental Medical Review Contractor (SMRC) reviews and Recovery Audit Contractor (RAC). No additional documentation requests will be issued for the duration of the PHE for the COVID-19 pandemic. Targeted Probe and Educate reviews that are in process will be suspended and claims will be released and paid. Current postpayment MAC, SMRC, and RAC reviews will be suspended and released from review. This suspension of medical review activities is for the duration of the PHE. However, CMS may conduct medical reviews during or after the PHE if there is an indication of potential fraud.

CMS also indicates in this guidance that a beneficiary’s signature will not be required for proof of delivery, as it relates to durable medical equipment services, during the PHE. In a follow-up exchange with CMS, the AAA has confirmed that this policy of not requiring a beneficiary’s signature also applies to ground ambulance providers and suppliers. The AAA has requested that this clarification for ground ambulances also be provided in a written FAQ.

Pause in the Non-Emergency Prior Authorization Model. CMS has paused the claims processing requirements for the Repetitive, Scheduled Non-Emergent Ambulance Transport Prior Authorization Model, effective March 29 until the end of the PHE. During this pause, claims for repetitive, scheduled non-emergent ground ambulance transports for the COVID-19 pandemic in States in which the model operates will not be stopped for pre-payment review if prior authorization has not been requested by the fourth round trip in a 30-day period. During the pause, the MAC will continue to review any prior authorization requests that have already been submitted, and ambulance suppliers may continue to submit new prior authorization requests for review during the pause. Claims that have received a provisional affirmative prior authorization decision and are submitted with an affirmed unique tracking number (UTN) will continue to be excluded from future medical review. Following the end of the PHE for the COVID-19 pandemic, the MACs will conduct postpayment review on claims otherwise subject to the model that were submitted and paid during the pause.

Telehealth Services. While CMS does not provide authority for ambulance organizations to bill directly for telehealth services, it does modify for the duration of the PHE the “direct supervision” requirements to allow physicians enter into a contractual arrangement with an entity that provides ambulance services to allow the physician to use the ambulance organization’s personnel as auxiliary personnel under a leased agreement. Under such circumstances, the provider or supplier would seek payment for any services it provided from the billing physician and would not submit claims to Medicare for such services directly.

Ongoing work of the AAA. The rule does not address two critical issues: (1) reimbursement for treatment in place and (2) direct reimbursement for telehealth services. The AAA will continue to work with CMS and the Congress to address these issues that are critical to meeting the needs of patients and your community during the epidemic.

Written by Amanda Riordan on . Posted in Operations, Patient Care, Press.

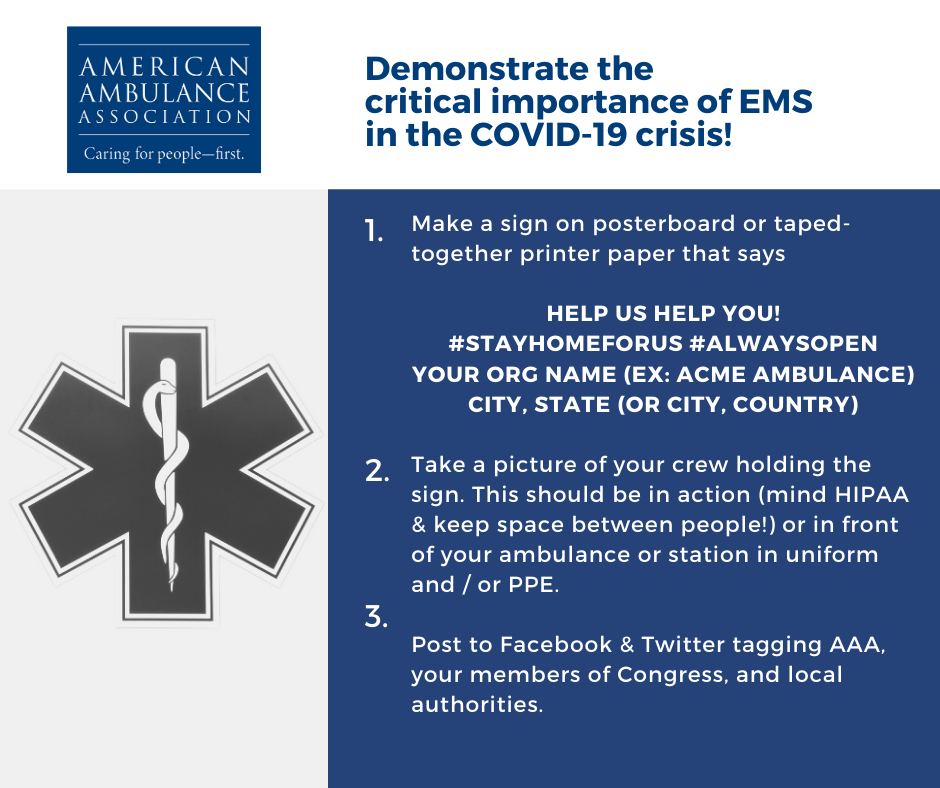

Demonstrate the value of EMS in the COVID-19 crisis!

#EMS is on the very front lines of the #COVID19 epidemic. We provide on-demand #mobilehealthcare for the most vulnerable patient populations, 24/7. Help AAA showcase the incredible importance of #Paramedics, #EMTs, and #Dispatchers in the response to this pandemic. Would you please capture a photo of yourselves in action, holding a simple sign? It is essential that we communicate visually with legislators, regulators, and the general public to help them understand the critically important role we play in saving and sustaining lives. #AlwaysOpen #StayHomeForUs

If practical, please consider showing your medics standing apart from one another (social distancing) if they are not in PPE.

Written by Aarron Reinert on . Posted in AAA HQ, Government Affairs, Operations, Patient Care, Stars of Life.

Dear Fellow AAA Members,

I write to you today during what we all recognize as an extraordinary time for EMS. As we collectively serve on the very front lines of the COVID-19 epidemic, we know that the most challenging times are still ahead. However, I am heartened by the collective resolve of the members of the American Ambulance Association to provide 24/7 on-demand mobile healthcare, no matter the circumstances.

As President of the Association, I am sharing below a brief summary of the AAA’s activities to support its members in the face of this devastating disease.

Members will receive updates via our Digest e-newsletter as we continue to make progress on these and other issues.

Please don’t hesitate to reach out to staff at info@ambulance.org or 202-802-9020 if we can be of any assistance. Thank you again for your service to your communities during this very difficult time.

Aarron Reinert

President, American Ambulance Association

Written by Rob Lawrence on . Posted in Employee Wellness, Global EMS, Operations, Patient Care, Professional Standards.

This guidance is written to offer American Ambulance Association members the situational background and a list of resources and websites with which to draw guidance and further updates on the latest situation with COVID-19, colloquially referred to as “Coronavirus.” Key information for this update has been drawn from the NHTSA EMS Focus series webinar What EMS, 911 and Other Public Safety Personnel Need to Know About COVID-19, which took place on February 24, 2020. The on-demand recording is available below.

The COVID-19 Coronavirus Disease was first reported in Wuhan China in December 2019. CDC identifies that it was caused by the virus SARS – CoV-2. Early on, many patients were reported to have a link to a large seafood and live animal market. Later, patients did not have exposure to animal markets which indicates person-to-person transmission. Travel-related exportation of cases into the US was first reported January 21, 2020. For reference the first North American EMS experience of COVID-19 patient transport, including key lessons learned, can be found in the EMS 1 article Transporting Patient 1.

Global investigations are now ongoing to better understand the spread. Based on what is known about other coronaviruses, it is presumed to spread primarily through person-to-person contact and may occur when respiratory droplets are produced when an infected person costs or sneezes. Spread could also occur when touching a surface or object that has the virus on it and when touching the mouth, nose, or eyes. Again, research is still ongoing, and advice and guidance will inevitably follow.

For the cases that have been identified so far, those patients with COVID19 have reportedly had mild to severe respiratory illness with symptoms including fever and shortness of breath. Symptoms have typically appeared 2 to 14 days after exposure. Both the WHO and CDC advise that patients that have been to China and develop the symptoms should call their doctors.

To date, 30 international locations, in addition to the US, have reported confirmed cases of COVID-19 infection. Inside the US, two instances of person-to-person spread of the virus have been detected. In both cases, these occurred after close and prolonged contact with a traveler who had recently returned from Wuhan, China.

The CDC activated its Emergency Operations Center (EOC) on January 21 and is coordinating closely with state and local partners to assist with identifying cases early; conducting case investigations; and learning about the virology, transmission, and clinical spectrum for this disease. The CDC is continuing to develop and refine guidance for multiple audiences, including the first responder and public safety communities.

As at the date of publication there is still no specific antiviral treatment licensed for COVID-19, although the WHO and its affiliates are working to develop this.

The following are recommended preventative measures for COVID-19 and many other respiratory illnesses:

The Centers for Disease Control (CDC) has issued its Interim Guidance for Emergency Medical Services (EMS) Systems and 911 Public Safety Answering Points (PSAPs) for COVID-19 in the United States.

The guidance identifies EMS as vital in responding to and providing emergency treatment for the ill. The nature of our mobile healthcare service delivery presents unique challenges in the working environment. It also identifies that coordination between PSAPs and EMS is critical.

Key points are summarized below:

The link between PSAPs and EMS is essential. With the advent of COVID19 there is a need to modify caller queries to question callers and determine the possibility that the call concerns a person who may have signs or symptoms and risk factors for COVID19.

The International Academy of Emergency Dispatch (IAED) recommends that agencies using its Medical Priority Dispatch System (MPDS) should use its Emerging Infectious Disease Surveillance (EIDS) Tool within the Sick Person and Breathing Problem protocols. For those that are not MPDS users, IAED is offering its EIDS surveillance Tool for Coronavirus, SRI, MERS and Ebola-free of charge under a limited use agreement.

The CDC recommends that while involved in the direct care of patients the following PPE should be worn:

Once transport is complete, organizations should notify state or local public health authorities for follow up. Additionally agencies should (if not done already) develop policies for assessing exposure risk and management of EMS personnel, report any potential exposure to the chain of command, and watch for fever or respiratory symptoms amongst staff.

While not specific to COVID-19, agencies should:

The COVID19 situation constantly evolving. Agencies should defer to their local EMS authorities, Public Health departments, and the CDC for definitive guidance. Going forward, the AAA will continue to both monitor the disease and alert issues to the membership.