Summary of Loans Under Paycheck Protection Program (Section 1102)

Download PDF

Overview

Section 1102 provides $349 billion for expedited individual loans up to $10 million through approved lenders that are guaranteed 100% by the U.S. government. The loan proceeds can be used to cover payroll support (such as employee salaries, paid sick or medical leave, insurance premiums) and mortgage, rent and utility payments incurred from February 15, 2020 through June 30, 2020.1 The maximum amount of a loan equals 2.5 months of average historical monthly payroll expenses, subject to certain exclusions.

On March 31, 2020, the Department of Treasury issued preliminary guidance regarding the imminent implementation of the Paycheck Protection Program (PPP). On April 2, 2020, the Small Business Administration (SBA) issued an interim final rule providing additional implementation guidelines and requirements for the PPP.

Small businesses and sole proprietorships started to apply for and receive PPP loans on April 3, 2020. Independent contractors and self-employed individuals can begin applying on April 10, 2020. The loans are first come, first served.

Benefits for Borrowers: Borrowers are eligible for loan forgiveness equal to the amount spent by the borrower during an 8-week period after the origination date of the loan on payroll costs, interest payment on any mortgage incurred prior to February 15, 2020, payment of rent on any lease in force prior to February 15, 2020, and payment on any utility for which service began before February 15, 2020. All borrower and lender fees, collateral and personal guarantee requirements are waived. The fixed interest rate is 1 percent and loan maturity is two years. No prepayment fees will be charged. Loan repayments can be deferred for six months.

Benefits for Lenders: Allows loans to be sold on the secondary market. Provides the regulatory capital risk weight of loans made under this program, and temporary relief from troubled debt restructuring (TDR) disclosures for loans that are deferred under this program. Lender compensation for servicing the loan is 5 percent for loans of not more than $350,000;

3 percent for loans of more than $350,000 and less than $2,000,000; and 1 percent for loans of not less than $2,000,000. Interim SBA regulations provide some protection for banks in the underwriting process.

The SBA lender list can be found at https://www.sba.gov/paycheckprotection/find.

Eligible businesses include:

- 1. Businesses with 500 or fewer employees (calculated as discussed below);

- 2. Small businesses as defined in the Small Business Administration Size Standards at 13 C.F.R. § 121.201;

- 3. 501(c)(3) nonprofits, 501(c)(19) veteran’s organizations and Tribal business concerns described in section 31(b)(2)(C) of the Small Business Act with not more than 500 employees;

- 4. Hotels, motels and restaurants with either 500 or fewer employees at each physical location or in the aggregate, without regard to affiliation under

13 C.F.R. §§ 121.103 and 121.301;

- 5. Franchises listed in the SBA Franchise Directory without regard to affiliation under 13 C.F.R. §§ 121.103 and 121.301; and

- 6. Sole proprietors, independent contractors, gig economy workers and self-employed individuals are all eligible.

Ineligible Businesses include but are not limited to:

- 1. Employers who elect to take advantage of “Delay of payment of employer payroll taxes” in CARES Act Section 2302 or the “Employee retention credit for employers subject to closure due to COVID-19” in Section 2301 are not eligible to take advantage of these loans (unless, in the case of the Section 2302 payroll tax deferral, the loan proceeds were not forgiven under either Section 1106 or Section 1109).

- 2. Financial businesses primarily engaged in the business of lending, such as banks, finance companies and factoring companies (pawn shops, although engaged in lending, may qualify in some circumstances); SBA’s Standard Operating Procedure 50 10 (SOP) provides this includes:

- i. Banks;

- ii. Life Insurance Companies (but not independent agents);

- iii. Finance Companies;

- iv. Factoring companies;

- v. Investment Companies;

- vi. Bail Bond Companies; and

- vii. Other businesses whose stock in trade is money.

- 3. Passive businesses owned by developers and landlords that do not actively use or occupy the assets acquired or improved with the loan proceeds (except Eligible Passive Companies under 13 C.F.R. § 120.111);

- 4. Businesses located in a foreign country (businesses in the United States owned by aliens may qualify);

- 5. Pyramid sale distribution plans;

- 6. Businesses deriving more than one-third of gross annual revenue from legal gambling activities;

- 7. Loan packagers earning more than one third of their gross annual revenue from packaging SBA loans;

- 8. Businesses primarily engaged in political or lobbying activities; and

- 9. Other businesses listed at 13 C.F.R. § 120.110.2

Counting Employees and Affiliation Rules:

SBA counts all individuals employed on a full-time, part-time or other basis, so this includes employees obtained from a temporary employee agency, professional employee organization or leasing arrangement. Contractors receiving IRS Form 1099 and volunteers are not considered employees.

The method for determining size includes the following principles:

- The average number of employees (including the employees of its domestic and foreign affiliates) for each of the pay periods for the preceding completed 12 calendar months.

- Part-time and temporary employees are counted the same as full-time employees.

- If a new company/venture, the average number of employees is used for each of the pay periods during which it has been in business.

- The average number of employees of a business with affiliates is calculated by adding the average number of employees of the business with the average number of employees of each affiliate. If the business has acquired an affiliate or been acquired as an affiliate during the applicable period of measurement or before the date on which it self-certified as small, the employees counted in determining size status include the employees of the acquired or acquiring concern. Furthermore, this aggregation applies for the entire period of measurement, not just the period after the affiliation arose.

- The employees of a former affiliate are not counted if affiliation ceased before the date used for determining size. This exclusion of employees of a former affiliate applies during the entire period of measurement, rather than only for the period after which affiliation ceased. However, if a business has sold a segregable division to another business concern during the applicable period of measurement or before the date on which it self-certified as small, the employees used in determining size status will continue to include the employees of the division that was sold.

The SBA’s affiliation rules substantially impact the ability of many entities to qualify for small business loans. On April 3, 2020, SBA issued an interim final rule (Affiliation IFR) about the applicability of affiliation rules at 13 C.F.R. §§ 121.103 and 121.301 to PPP loans. This supplements the SBA’s April 2 interim final rule.

The Affiliation IFR clarifies that SBA’s affiliation rules apply to all PPP applicants unless an exemption provided in the CARES Act applies. It also adds a new exemption, providing that affiliation rules do not apply to relationships of any church, faith-based organization, or entity that is based on religious teaching or belief. Affiliation rules a waived for:

- any business concern with not more than 500 employees that, as of the date on which the loan is disbursed, is a hotel, motel, or restaurant;

- Franchises listed in the SBA Franchise Directory;

- business concern that receives financial assistance from a company licensed under section 301 of the Small Business Investment Act of 1958 (15 U.S.C. 681); and

- the relationship of a faith-based organization to another organization if the relationship is based on a religious teaching or belief or otherwise constitutes a part of the exercise of religion.

Concerns and entities are affiliates of each other when one controls or has the power to control the other, or a third party or parties controls or has the power to control both. It does not matter whether control is exercised. SBA’s affiliation rules applicable to financial assistance programs, found at 13 C.F.R. §§ 121.103, provide that any of the following circumstances is sufficient to establish affiliation.

Ownership:

- a. A concern is an affiliate of an individual, concern, or entity that owns or has the power to control more than 50 percent of the concern’s voting equity.

- b. If no individual, concern, or entity is found to control, SBA will deem the Board of Directors or President or Chief Executive Officer (CEO) (or other officers, managing members, or partners who control the management of the concern) to be in control of the concern.

- c. SBA will deem a minority shareholder to be in control, if that individual or entity has the ability, under the concern’s charter, by-laws, or shareholder’s agreement, to prevent a quorum or otherwise block action by the board of directors or shareholders.

Stock options, convertible securities, and agreements to merge:

- a. Stock options, convertible securities, and agreements to merge are treated as though the rights granted have been exercised for purposes of determining control.

- b. However the following are not given such present effect:

- i. Agreements in negotiations;

- ii. options, securities, and agreements subject to conditions precedent which are incapable of fulfillment or where the probability of the transaction occurring is extremely remote; and

- iii. options, securities, and agreements that give entities in control of the operative business concern the ability to divest all or part of their ownership interest in order to avoid a finding of affiliation.

Common management:

- a. Affiliation arises where the CEO or President of the applicant concern (or other officers, managing members, or partners who control the management of the concern) also controls the management of one or more other concerns.

- b. Affiliation also arises where a single individual, concern, or entity that controls the Board of Directors or management of one concern also controls the Board of Directors or management of one of more other concerns.

- c. Affiliation also arises where a single individual, concern or entity controls the management of the applicant concern through a management agreement.

Identity of interest

- a. Affiliation may arise among two or more individuals or firms with an identity of interest. Individuals or firms that have identical or substantially identical business or economic interests (such as close relatives, individuals or firms with common investments, or firms that are economically dependent through contractual or other relationships) may be treated as one party with such interests aggregated.

- b. Where SBA determines that such interests should be aggregated, an individual or firm may rebut that determination with evidence showing that the interests deemed to be one are in fact separate.

Totality of the circumstances:

- a. SBA may consider all connections between the concern and a possible affiliate. Even though no single factor is sufficient to constitute affiliation, SBA may find affiliation on a case-by-case basis where there is clear and convincing evidence based on the totality of the circumstances.

- b. However, where an SBA Lender has made a determination of no affiliation, SBA will not overturn that determination as long as it was reasonable when made given the information available to the SBA Lender at the time.

Loan Amount

Eligible borrowers can seek a total loan amount equal to monthly average of payroll over the past 12 months, multiplied by 2.5. “Payroll costs” include salary, wages, commissions, cash tips, paid vacation or leave, insurance premiums and other group health care payments, allowance for separation or dismissal, paid retirement benefits and state or local taxes. The statute also allows a business to include the “sum of any compensation to or income of a sole proprietor that is a wage, commission, or income, net earnings from self-employment, or similar compensation” in payroll costs to the extent these amounts are in an amount that is not more than $100,000 in one year.

“Payroll costs” do not include individual compensation in excess of $100,000, certain taxes (including the employer’s share of the social security portion (6.2% of employee wages) and the Medicare portion (1.45% of employee wages) of payroll taxes known as Federal Insurance Contributions Act (FICA)) and ordinary income tax withholding, compensation paid to an employee if their place of residence is outside the United States and paid leave under the Families First Coronavirus Relief Act.

Example: An employer with total payroll costs of $12 million over the past 12 months is eligible for a PPP loan of $2.5 million ($1 million average monthly payroll cost x 2.5).

If you received an Economic Injury Disaster Loan (EIDL) between January 21, 2020 and April 3, 2020, you can add the outstanding amount of that loan (less the amount of any “advance” under a COVD-19 EIDL) to your calculated total (average monthly payroll cost x 2.5) for purposes of calculating your maximum loan amount.

Example: An employer calculated the $2.5 million amount in the above example, and also has an outstanding COVID-19 EIDL of $600,000, $100,000 of which was an advance. The employer is eligible for a PPP loan of $3 million ($2.5 million plus

$600,000, minus $100,000 advance).

Borrowers that were not in business between February 15, 2019 and June 30, 2019 can receive a loan amount equal to 2.5 times their average payroll costs between January 1, 2020 and February 29, 2020. Borrowers that have existing loans under certain SBA programs may be subject to different limits.

Certifications, Fees and Allowable Uses

Lenders must consider whether the borrower was in operation before February 15, 2020 and had employees for whom the borrower paid salaries and payroll taxes, (or paid independent contractors under Form 1099-MISC). Borrowers also must make a good faith certification on the PPP application form that:

- Current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant;

- The Applicant is eligible to receive a loan under the rules in effect at the time this application is submitted that have been issued by the Small Business Administration (SBA) implementing the Paycheck Protection Program under Division A, Title I of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) (the Paycheck Protection Program Rule).

- The funds will be used to retain workers and maintain payroll, or make mortgage payments, lease payments and utility payments;

- Any loan received by the Applicant under Section 7(b)(2) of the Small Business Act between January 31, 2020 and April 3, 2020 was for a purpose other than paying payroll costs and other allowable uses loans under the Paycheck Protection Program Rule;

- The recipient has not received loan amounts under the same subsection for the same purpose between February 15, 2020 and December 31, 2020;

- The Applicant will provide to the Lender documentation verifying the number of full- time equivalent employees on the Applicant’s payroll as well as the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments and covered utilities for the eight-week period following this loan; and

- All information provided in the application and all supporting documents and forms is true and accurate in all material respects, acknowledging that knowingly making false statements is punishable by imprisonment of not more than 5 years and/or a fine of up to $250,000.

The PPP waives certain fees typically required for SBA loans, including those under Sections 18(A) and 23(A) of the statute. Applicants also do not need to certify that they are unable to obtain credit elsewhere, or provide a personal guarantee or collateral for a covered loan. However, loan proceeds received under PPP cannot be used for the same costs for which proceeds from a loan received through the Economic Disaster Loan Assistance Program are used.

Use of Loan Proceeds, Forgiveness and Reduction in Forgiveness Amount

Loan proceeds may only be used to pay: (1) payroll costs; (2) costs related to the continuation of group health care benefits during periods of paid sick, medical or family leave, and insurance premiums; (3) mortgage interest payments; (4) rent payments; (5) utility payments; (6) interest on any debt obligation incurred before the covered period; or (7) refinancing EIDL made between January 31, 2020 and April 3, 2020.

Loan amounts expended during the eight-week period following the loan origination will be forgiven, up to the total amount of the loan, if used for payroll costs (up to an annualized rate of

$100,000 per employee). In addition, up to 25 percent of the loan forgiveness amount may be attributable to qualifying non-payroll costs including: (1) interest on a mortgage obligation; (2) rent; or (3) covered utilities. The CARES Act provides an exception from the general rule that debt forgiveness is taxable, so that that amount of loan forgiveness will not be included in the borrower’s taxable income.

The forgiveness amount will be reduced if the employer reduces the number of full-time equivalent employees, or reduces employees’ salary and wages beyond a certain amount during the eight-week period.

First, the forgiven amount will be reduced by multiplying the amount of forgivable costs by:

- the average number of full-time equivalent employees (FTEs) employed during the eight weeks following the loan origination, divided by

- the average number of FTEs employed between either February 15, 2019 and June 30, 2019, OR January 1, 2020 and February 29, 2020 (the employer may elect the period used).

*Seasonal employers must measure the average number of FTE employees for the period from February 15, 2019 to June 30, 2019.

Example: Borrower had average FTEs of 300 employees per month from February 15- June 30, 2019, and average FTEs of 250 employees per month from January 1- February 29, 2020. The borrower obtains a $2.5 million loan and uses all of the loan proceeds to pay for forgivable expenses. During the eight-week period following the loan, the borrower employ an average of 150 FTEs per month. Employer elects January 1-February 29, 2020 baseline period. Forgiveness on the loan is reduced as follows:

150 Covered Period FTEs / 250 Baseline Period FTEs = 0.6

$2.5 million x 0.6 = $1.5 million forgiven

*Remaining $1 million principal must be repaid at applicable interest rate over remaining term of loan

Second, the forgiven amount will be reduced by the amount of any reduction in total salary or wages during the eight weeks after origination that exceeds 25 percent of an employee’s total salary or wages during most recent full quarter during with the employee was employed.

Employees that earned annualized pay in excess of $100,000 in 2019 are not counted for these purposes.

Example: Borrower obtains a $2.5 million loan and uses all of the loan proceeds to pay for forgivable expenses. During the eight-week period following the loan, the borrower reduces pay of hourly employees by 50 percent, resulting in a total reduction in compensation of $1,500,000. The borrower also reduces the pay of its five officers, all of whom earn more than $100,000, by 50 percent. The reduction in officer pay produces a savings of $250,000. No reduction in FTEs occurs. Forgiveness on the loan is reduced as follows:

$2.5 million – $750,000 (comp. reduction in excess of 25 percent to employees earning less than $100,000) = $1.75 million forgiven

(Remaining $750,000 principal must be repaid at applicable interest rate over remaining term of loan)

Borrowers may “cure” reductions in FTEs or compensation for purposes of forgiveness in certain circumstances. Specifically, these reductions will not reduce the forgiveness amount if:

- The borrower reduces the number of FTEs between February 15, 2020 and the date 30 days after the enactment of the Act and eliminates that reduction no later than June 30, 2020.

Example: Same as above. Borrower has a baseline of 250 FTEs and lays off 100 FTEs on March 1, 2020. Average FTEs over the eight-week period is 150, but the borrower rehires 75 FTEs on June 15, 2020.

225 Covered Period FTEs / 250 Baseline Period FTEs = 0.9

$2.5 million x 0.9 = $2.25 million forgiven

- The borrower reduces the salary and wages of employees between February 15, 2020 and the date 30 days after enactment of the Act and eliminates the reduction no later than June 30, 2020.

Example: On March 15, 2020, the borrower reduces the pay of hourly employees by 50 percent, resulting in a total reduction in compensation of $1,500,000. On June 15, 2020, the borrower restores all hourly employees to full pay.

No reduction in forgiveness amount.

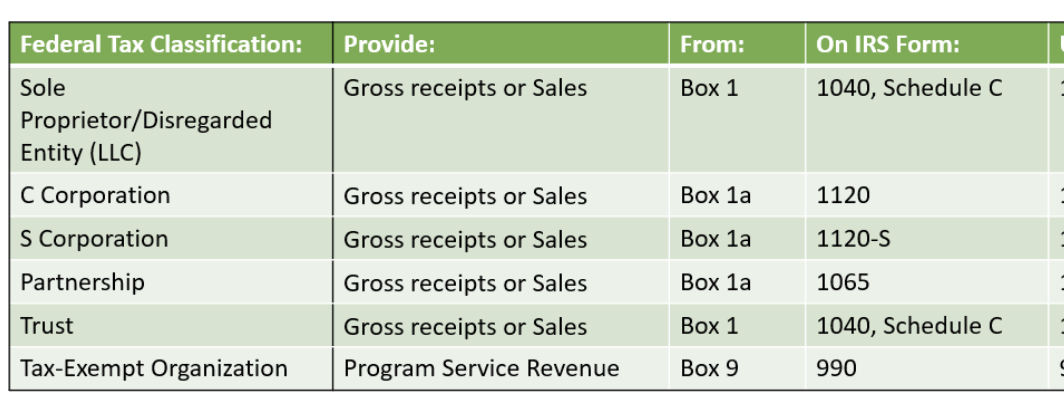

Borrowers must provide sufficient documentation to demonstrate compliance with these requirements, including: (1) payroll tax filings reported to the Internal Revenue Service; (2) state income, payroll and unemployment insurance filings; and (3) other documentation, including cancelled checks, receipts or account transcripts, to verify mortgage interest, rent and utility payments.

Borrowers also must certify that the amounts for which forgiveness is requested were used to retain employees and make covered mortgage interest, rent or utility payments.

SBA intends to issue additional guidance on the loan forgiveness provisions of the PPP loan.

Application Process

Beginning on April 3, 2020, you can apply at any lending institution that is approved to participate in the Small Business Administration’s 7(a) lending program. Additionally, upon completion of the CARES Act Section 1102 Lender Agreement (SBA Form 3506), the following types of lenders will be “automatically qualified” to issue PPP loans provided they are not currently designated in Troubled Condition:

- Federally insured depository institutions or federally insured credit unions;

- Farm Credit System institutions (other than Federal Agricultural Mortgage Corporations); and

- Certain depository or non-depository financing providers.

However, the $349 billion in funds may not still be available by the time additional qualified lenders submit the requisite Lender Agreement. You will not have to visit any government institution to apply for the loan. Applicants are eligible to apply for the PPP loan until June 30, 2020.

For eligibility purposes, lenders will not be determining eligibility-based repayment ability, but rather whether the business was operational on February 15, 2020 and had employees for whom it paid salaries and payroll taxes (or paid independent contractors).

Notes

- Section 7(a)(36)(A)(iii) of the Small Business Act (15 U.S.C. § 636(a)(36)(A)(iii)), as added by the CARES Act, defines the covered period for the PPP loan program as the period beginning on February 15, 2020 and ending on June 30, 2020. However, this covered period is not further addressed in the interim final rule SBA issued on April 2, 2020.

- Although this list of ineligible businesses also includes: “[b]usinesses principally engaged in teaching, instructing, counseling or indoctrinating religion or religious beliefs, whether in a religious or secular setting,” SBA issued guidance on April 3, 2020, following the issuance of its interim final rule on affiliation earlier that day, stating that this provision “impermissibly exclude[s] some religious entities” and therefore it will decline to enforce this provision with regard to PPP and EIDL. See https://www.sba.gov/sites/default/files/2020-04/SBA%20Faith- Based%20FAQ%20Final.pdf.

- The Department of Treasury issued guidance on affiliation in conjunction with the Affiliation IFR, which largely mirrors the affiliation rules found at 121.301.

- Section 7(a)(36) of the Small Business Act (15 U.S.C. § 636(a)(36)), as added by the CARES Act, does not place any requirement on the amount of PPP loan proceeds that must be applied to any particular eligible expense. However, the interim final rule SBA issued on April 2, 2020, requires that at least 75% of the PPP loan proceeds be used for payroll costs.